V.F. Corporation (NYSE:VFC) sells branded apparel, footwear, and accessories under a portfolio of brands. The brands include large, globally recognized names such as the North Face, Vans, Timberland, and Dickies, but also smaller brands including Icebreaker, Napapijri, JanSport, and Supreme which was acquired in 2020 for $2.1 billion.

The stock has lost the majority of its value from 2021 forward, with VFC’s poor brand management and expensive M&A strategy, leading to high debt and poorly performing brands. A thorough turnaround plan is in motion, but no effects were yet seen in Q4, as revenues declined by -13.4%.

Ten Year Stock Chart (Seeking Alpha)

VFC’s Lackluster Brand Performance Sees No End Yet

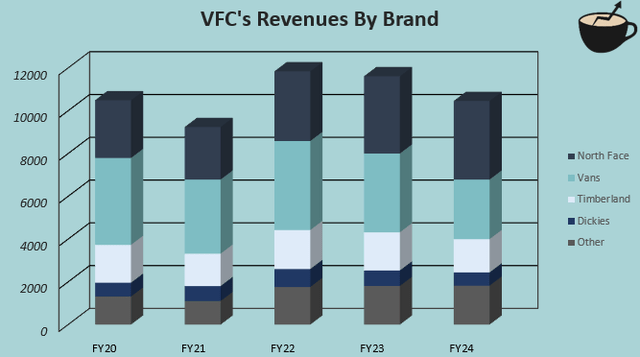

VFC has had a weak recent history of growing many of the company’s key brands. Vans, VFC’s largest brand until FY2024, revenues have shrunk from $4063.4 million in FY2020, prior to large Covid pandemic issues to just $2785.7 million in FY2024 at a CAGR of -9.0%. Timberland, the third largest VFC brand, has had a CAGR of -3.1% in the same period with Dickies following at a -1.1% CAGR – it seems that the company is unable to adapt to changing customer demand with many stagnant brands.

The 2020 acquisition of Supreme is also an example of VFC’s history of poorly led brands. The brand added around $500 million to VFC’s sales in FY2022, with ambitious plans to scale the growth into $1 billion through new stores, brand collaborations, and global expansion with VFC’s large global distribution network. Since Google Trends shows stable global search term volume for Supreme, and the company recorded goodwill and intangible asset impairment charges totaling $735 million in FY2023 with an additional $313.1 million in FY2024 due to the brand’s weak performance. VFC is now reportedly considering selling the business.

Author’s Calculation Using VFC’s 10-K Filing Data

The North Face brand is VFC’s outlier as the stagnant brand image from FY2014 to FY2017 has been turned around into an impressive CAGR of 8.0% from FY2020 to FY2024, as the company has become VFC’s largest brand. The rapid growth from the best-performing brand has started to stagnate too though, with -5.3% in year-over-year revenues in Q4 and a 1.7% growth in all of FY2024. The Q4 total revenue growth was -13.4%, showing one of VFC’s deepest revenue declines in recent history.

The poor sales performance has ultimately led to declining margins, as the operating margin in FY2024 was only 6.0% after a double-digit long-term level with an average of 11.4% from FY2016 to FY2020. Further declines pose a similar threat as well, as SG&A scales with inflation and failed growth initiatives against declining gross profit.

Don’t Take Reinvent Turnaround Plan Success at Face Value

To combat the poor performance, VFC introduced the Reinvent turnaround plan in the Q2/FY2024 report press release. The plan was introduced by Bracken Darrell, VFC’s new CEO that was appointed a few months prior to the plan’s announcement.

In the plan, VFC targets to improve results in North America with a change in the operating model, turn around the Vans brand with a new brand president appointment, cut costs by $300 million from fixed costs, and reduce debt – the changes reflect a key shift in VFC’s strategy, and a clear focus on changing Vans’ turnaround.

The $300 million in fixed cost reductions seems to be a great profitability driver, if successfully implemented without worsening organizational performance. Yet, a brand turnaround is needed for the company’s earnings to sustain, as margins have constantly taken a hit from lower sales, leveraged by VFC’s nearly $6 billion in interest-bearing debt.

I don’t believe that the Reinvent plan’s turnaround targets should be taken at face value before better demonstration from brands’ performance – a turnaround plan for Vans was already presented in the 2022 Investor Day for Vans, as was done for the North Face previously. Still, the Vans brand hasn’t yet even seen any stabilization several quarters later. Communicated growth targets for Timberland and Dickies have been missed as well, with continuous revenue declines.

The plan is now more thorough than the plan seen in the 2022 Investor Day, especially as Bracken Darrell was appointed as a new CEO to drive a change in the company. Bracken Darrell has an impressive resume, being the prior CEO of Logitech International (LOGI) and working in senior roles at Procter & Gamble (PG), Whirlpool (WHR), and General Electric (GE). Yet, leading fashion brands can be challenging, as maintaining and creating demand requires deep, constant customer and trend knowledge – while the new CEO is praised for the Old Spice brand turnaround, a similar turnaround of Vans could be more challenging, and likely requires a different type of branding strategy.

Performance continues to show no signs of improvements yet. Vans’ sales declined by –26.3% in Q4, the North Face’s by -5.3%, Timberland’s by -13.7%, and Dickies’ by -15.2%. Other brands were near stable with a slight decline. The Vans search term still shows continued weakness on Google Trends.

More recently, in February, VFC announced that the company is going through a strategic portfolio review, and now seeks to potentially sell many of its smaller brands. The review could create upside, but no sales have been announced yet.

The Stock Valuation Prices In Too Much Improvements

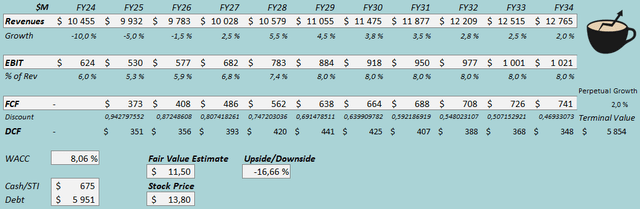

I constructed a discounted cash flow [DCF] model to estimate a rough fair value for the stock. In the model, I factor a semi-successful turnaround, leaving margins higher than currently, but not quite at the long-term level.

For revenues, I estimate a -5% decline in FY2025, a -1.5% decline in FY2026, but a return into a better performance from FY2027 forward. From FY2026 to FY2034, I estimate the revenue CAGR at 3.4%, after which the growth ends at a perpetual 2%.

As VFC targets $300 million in cost savings, and as I estimate better revenues after a few years, I estimate the EBIT margin to be leveraged from 5.3% in FY2025 into an eventual 8.0%. The company has quite low capex and incremental working capital needs, making the cash flow conversion quite good.

DCF Model (Author’s Calculation)

The estimates put VFC’s fair value estimate at $11.50, 17% below the stock price at the time of writing – even if the Reinvent turnaround plan shows good amount of improvements, the stock seems to have a moderate overvaluation. Good upside seems to require a near full brand turnaround, which I don’t believe that investors should yet expect.

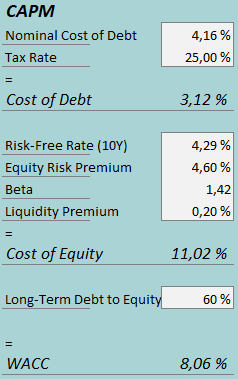

A weighted average cost of capital of 8.06% is used in the DCF model. The used WACC is derived from a capital asset pricing model:

CAPM (Author’s Calculation)

In Q4, VFC had $61.8 million in interest expenses, making the company’s interest rate 4.16% with the current amount of interest-bearing debt. I estimate a long-term debt-to-equity ratio of 60% due to VFC’s continued leveraged balance sheet, but plans for deleveraging. I believe that refinancing the debt would now likely result in a higher interest rate, posing a moderate risk to the cost of capital.

To estimate the cost of equity, I use the United States’ 10-year bond yield of 4.29% as the risk-free rate. The equity risk premium of 4.60% is Professor Aswath Damodaran’s latest estimate for the United States, updated on the 5th of January. Seeking Alpha estimates VFC’s beta at 1.42. Finally, I add a liquidity premium of 0.2%, creating a cost of equity of 11.02% and a WACC of 8.06%.

Notable Upside Risk

The bearish thesis still has a major upside risk – if the Vans turnaround turns out to be highly successful, a rise back into long-term margins and better growth could make the stock undervalued at the current price. At the FY2016-FY2020 average operating margin of 11.4% from FY2027 forward, the DCF model would estimate upside of 65%. Still, signs of such a turnaround aren’t yet seen, and such a scenario shouldn’t be priced as likely yet.

Also, the strategic alternative review could still well pose upside, if VFC is able to sell notable brands for a good price – the Timberland, Dickies, and Supreme brands could get VFC a good consideration if a potential buyer is more confident in leading the brands. Speculation around potential sales are rising, and a sale of one or more of VFC’s brands, in my opinion, is likely to happen at some point. Yet, the valuation in potential sales could be disappointing; sales aren’t a definite way to create upside.

I urge investors to watch the brand performance closely in the upcoming quarters, as a full turnaround could still be very valuable for shareholders.

Takeaway

VFC’s new CEO has started a significant turnaround plan to fix the underperforming brands. Costs are planned to be reduced dramatically, and Vans is planned to show a better performance through a leadership change and operational changes. Yet, investors shouldn’t believe in a near-full turnaround yet – a Vans turnaround has been tried for a while already, and Bracken Darrell doesn’t have a ton of experience in leading fashion brands, which could still prove to be a challenge. The Q4 performance also continues to show weakness across brands, with even the North Face now showing weakness after prior turnaround. The valuation seems to take good improvements as a base scenario, which I doubt for the time being. While brand sales or a turnaround could pose great upside, the risk-to-reward doesn’t seem good, and I initiate V.F. Corporation with a Sell.

Read the full article here