In the time that Vaalco Energy (NYSE:EGY) has had since the acquisition with TransGlobe Energy back in fiscal year 2022, this management has done a lot in roughly one and one half years with that acquisition. Management also closed on the Svenska acquisition since then as well. Not only is production increasing as a result of these activities, but the company has also maintained a debt-free balance sheet with a sizable cash balance throughout the whole time. With some sizable projects on the horizon, management is in a good position to increase production further while maintaining that strong balance sheet.

The last article noted that there has been a dependence upon showing a fair amount of growth through acquisitions. This company has diversified by doing business in areas where the purchase price allows for fast paybacks. However, diversification will not completely offset the risk of doing business in those areas.

What’s likely to happen is some production growth in some of the more stable areas like Egypt and Canada in the future.

Area Of Operations

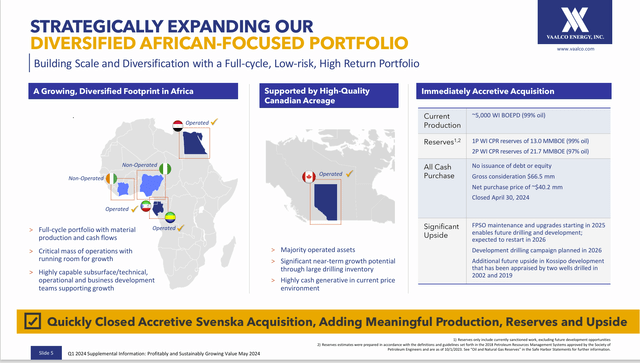

These acquisitions have made the company far less dependent upon a single source of cash flow. That diversification (even among some elevated risk areas) has decreased the significance of each area of operation.

Vaalco Energy Area Of Operations Map (Vaalco Energy First Quarter 2024, Corporate Earnings Presentation)

The company now has at least one safe area of operation in Canada. Probably the next lowest risk operation is in Egypt. Both of these are considered far more stable than the original source of cash flow in Gabon.

The recently completed Svenska acquisition will add production to the existing company production. However, there will be negative production comparisons next year when the FPSO planned repair schedule will mandate that production go offline for about a year. After that, then it will be back to production and examining growth prospects.

Management does have the ability to make up for that lost production elsewhere. But it’s a steep climb for a small company like this.

This is a small company that engages in rather sizable offshore projects. It’s not unusual for these projects to add thousands of barrels to production or to have an issue that causes lots of barrels to go offline until the issue is resolved.

A larger company has far more production, so that something like this is not as significant. The land-based Canadian and Egyptian production may make this something that can be made up. Those operations can be expanded relatively cheaply compared to the original offshore business.

Risky Business And High Upfront Costs

Nonetheless, the offshore business is a business that has a lot of upside potential. Management generally looks for smaller discoveries that are not worth it for a much larger company to develop. This company can often make a good living off those discoveries. The fact that oil was discovered takes a whole lot of risk out of the exploration part of the company’s business.

Small companies like this need to be very careful with risk because an offshore well can run as much as $30 million. For a company like Exxon Mobil (XOM) that is “chump change” that disappears in the billions of dollars reported quarterly. So, shareholders rarely see anything unless management does an announcement.

But with Vaalco, a $30 million dry hole (along with associated costs) is a major earnings event that can wreck a quarter and cause the market to revalue the whole fiscal year. So far, the debt free balance sheet points to excellent risk management. Not many successful offshore operators are this small.

Entry Into Still Another African Country

A material addition to this acquisition information was announced by management recently. The reserves purchased increased by 3.9 million BOE from the original assessment. Keep in mind that this is still an educated guess by an outside party. Still, it means that the reserves were purchased for less than $3 BOE, and it is likely mostly oil.

In the same announcement, management stated that this increase played a significant part in proved reserves climbing more than 50% in the last fiscal year. Please see the original records for details on this.

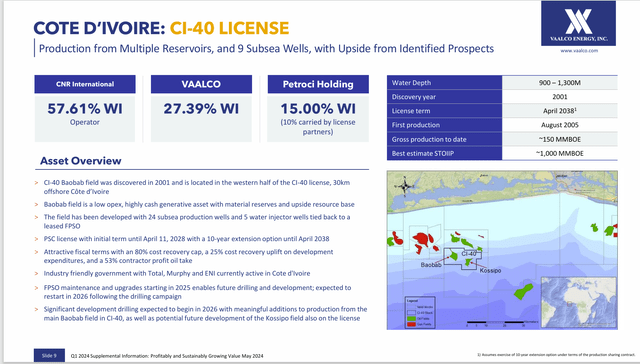

Management has become involved in another production area in the country of Cote d’Ivoire. The following will review some past discussions while adding a lot more details to give a better overall view of this project.

Vaalco Energy Area Of Operations Map (Vaalco Energy First Quarter 2024, Corporate Earnings Presentation)

This is the Svenska acquisition that recently closed. It will add significant production to the company reporting, as noted. But next year, it will also go offline for the FPSO maintenance and repairs. Not yet stated is management’s liability in this repair process.

While the market loves the addition of this project for cash because it raises production, Mr. Market will not be so happy when those barrels of production are gone for about a fiscal year (give or take a lot depending upon what is found once the repairs begin).

This is a non-operated project with Canadian Natural Resources (CNQ) the operator. Still, the details of an FPSO and then planning on growing production after that could take a significant amount of time. Even with the cash balance that the company maintains, the anticipated growth could be a major cash drain for the company when that time arrives.

The first quarter conference call slides show production heading past 25,000 BOED for the fiscal year with this production added in. But the market is likely more concerned about the exit rate production at year-end 2024 combined with the projected production for the first quarter without this volume when the FPSO goes for repairs. Don’t be surprised if there’s some stock price volatility because of this.

Along with this comes a partnership with Exxon Mobil (XOM) in Nigeria that has a discovery in its very early stages. This discovery likely has some years ahead before there would be any production. Nigeria is a place where the government is supportive of the oil and gas industry. But that government is also very ineffective. Mitigating some of the challenges of doing business in Nigeria would be the presence of a major like Exxon Mobil as the operator and the fact that this is an offshore discovery.

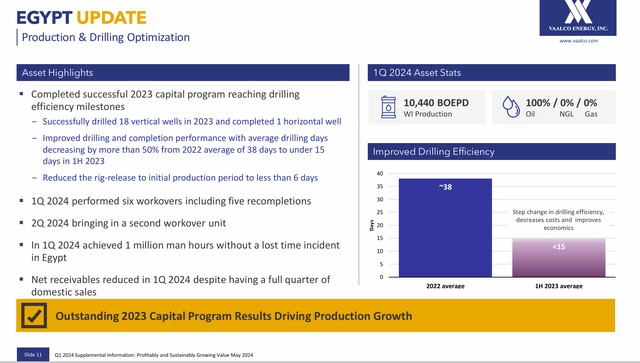

Egypt

Management noted that the first horizontal well was drilled in Egypt. Since the acquisition, the major change here has been a rapid pickup in the business pace. That has been combined with a relentless effort (that continues) to get the receivables from the Egyptian government down. If this remains successful, then less working capital is needed. Clearly, this management is bringing an energy level to the Egyptian business that we have not seen in a long time.

Vaalco Summary Of Status Of Egyptian Business (Vaalco Energy First Quarter 2024, Corporate Earnings Presentation)

The significance of that horizontal well is that it may be far less expensive to drill successful horizontal wells than to do a major production of secondary recovery by using the water flooding method.

In the United States, for example, the Austin Chalk play in Texas was revolutionized virtually overnight by the advent of horizontal drilling combined with modern completion techniques. That might happen here as well.

In the meantime, management is clearly cutting costs throughout the whole process since acquiring the business. The previous management negotiated a better contract with the Egyptian government that allows for profitable long-term secondary recovery. The current operations appear to be taking full advantage of that new contract.

Note that the receivables balance has also been reduced since the acquisition of this operation. That was a perennial issue when TransGlobe Energy operated this business.

In summary, the report not only emphasizes production growth, but it also emphasizes cost control to increase the profitability of that growth as well.

Gabon

This country is responsible for roughly 40% of the reported production. That’s down considerably from 100% when I first began to follow the company.

Growth in the offshore business is often lumpy because the projects are large sized. Failures are often big as well. Hence, the need for diversification. Nonetheless, the track record has been good considering the “small company-big project” nature of this business.

This part of the business had a relatively quiet year. The other parts of the business appear to be well suited to smoothing over the lumpy growth here.

Management has turned this part of the business into quite a cash flow machine.

Canada

Management recently announced a successful drilling program. Note that management is moving to longer wells of 2.5 to 3 miles in length to increase the economic viability of this particular set of leases. The understated part is that these wells are also producing liquids whereas (when purchased) the business was purchased as natural gas producing.

Management has since been very successful at increasing the value of the production mix by increasing the liquids percentage of production. In fact, the profit progress in the past two years has been a considerable acceleration from my past coverage.

This production is very roughly 10% of the corporate total production. But the progress made so far indicates that this operation could become larger through organic growth and serve as a foundation that offsets some of the elevated business risks elsewhere.

Summary

Vaalco is a company with no debt and a relatively large cash balance. This is likely necessary considering the places that the company does business in. Generally, the company offsets the business risk by requiring fast paybacks of any acquisition made. So far, that strategy appears to be working. If the worst happens and the company must leave an area of operations for whatever reason, the original purchase price has been returned for all but the most recent acquisitions. Therefore, the risk of loss to shareholders is minimal.

Generally, companies with no debt rarely get into serious trouble. The cash balance allows the company to make repeated attempts to succeed. A management team this conservative will usually succeed as a result.

Still, because of the elevated business risk, this strong buy consideration is probably best considered as part of a basket of companies rather than loading up a large position.

Value here is a very difficult topic because there are parts of this business that command a very low valuation. Earlier articles covered a few coups in the area. That kind of decimates valuations for business purposes very fast. Probably the best strategy is to wait for a “quiet period” that results in the market forgetting the instability present in a few areas where this company does business.

Risks

As noted above, several of the countries in which the company does business lack modern infrastructure, have stability issues, or are challenging locations for still more reasons. The diversification of the company does help, but does not eliminate the risk.

Doing business in Africa is a niche business, more so than many locations that I follow. The loss of key personnel that know how to do business on the continent is probably more critical because of this factor. The company’s plans could be materially setback if a key person’s services were lost.

Any upstream company is subject to the low future visibility of commodity prices along with the current volatility. A severe and sustained downturn of commodity prices could easily change the future outlook.

Read the full article here