Sentiment reached negative extreme

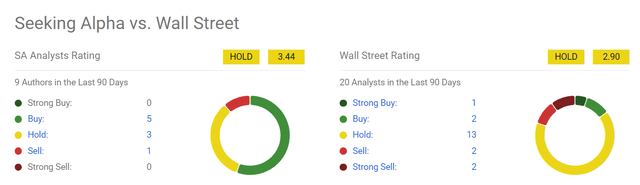

The sentiment surrounding Walgreens Boots Alliance (NASDAQ:WBA) has now reached an extreme in my view – and for many good reasons. As seen in the next chart, neither Main Street (approximated by Seeking Alpha writers) nor Wall Street analysts like the stock. To wit, among the 10 Seeking Alpha analyses published on the ticker in the past 90 days, no one rated it as a strong buy, and it received an average rating of 3.44. On Wall Street’s side, 20 analysts covered the stock in the past 90 days. Only one rated the stock as a strong buy and the overall rating is even lower at 2.9.

Seeking Alpha data

Indeed, there are good reasons behind the negative sentiment. To name a few, the stock will have to exit the Dow, earnings are struggling, and its dividends were recently cut. And I’m afraid the list can go much longer.

Against this backdrop, the goal of this article is to argue for a contrarian thesis on the stock. In the remainder of this article, I will explain why WBA could be an interesting investment opportunity. I will argue why the negatives have all been priced in at its current multiples, while the positives are largely ignored (such as the new CEO and his many undergoing initiatives).

Exit from the Dow Index

Let me first address the elephant in the room: WBA’s exit from the Dow. Recently, S&P Dow Jones Indices said in February that:

Walgreens Boots Alliance would be getting the boot from the 30-stock index. The change is intended to reflect “the evolving nature of the American economy” by increasing the Dow’s consumer retail exposure.

Amazon (AMZN) now replaces WBA in the Dow. There are, of course, potential downsides for WBA due to its exit from the Dow. For example, index funds that track the Dow will be forced to sell their WBA holdings, which could lead to a temporary dip in the stock price. Being part of a prestigious index like the Dow also brings increased brand recognition and investor attention. WBA’s exit might lead to less analyst coverage and decreased investor interest.

However, these negatives are mostly temporary in nature, in my experience, for a few reasons. First of all, not all investors of funds follow the Dow index. Many actively managed funds and investors (like yours truly) research companies regardless of index inclusion. Secondly, in the long run, a company’s success depends on its fundamentals and overall strategy, not its inclusion in an index. General Electric’s (GE) recent exit from the Dow provides a good example. In 2018, GE was removed from the Dow due to declining share prices. While GE stock did experience a short-term dip following the announcement, it has since recovered significantly, as seen in the chart below.

Next, I will explain why I think the downsides have already been priced anyway in the case of WBA.

Seeking Alpha data

Q2 preview and return projections

WBA is scheduled to report earnings on March 28, 2024. According to Zacks Investment Research,

The report will be for the fiscal Quarter ending Feb 2024. Based on 9 analysts’ forecasts, the consensus EPS forecast for the quarter is $0.84. The reported EPS for the same quarter last year was $1.16.

The large EPS drop indeed reflects the many headwinds that WBA has been coping with in recent quarters. Given these headwinds, I do not expect an earnings surprise. I would pay close attention to the company’s efforts and progress toward improving its profitability, cash flow, and balance sheet under the leadership of CEO Tim Wentworth. I expect Wentworth to right size the business, improve execution, and keep paying down its debt (for example, with proceeds from divestments of non-core assets). Also, its cost management program, including a workforce cutback, is a key area of interest for me during the call.

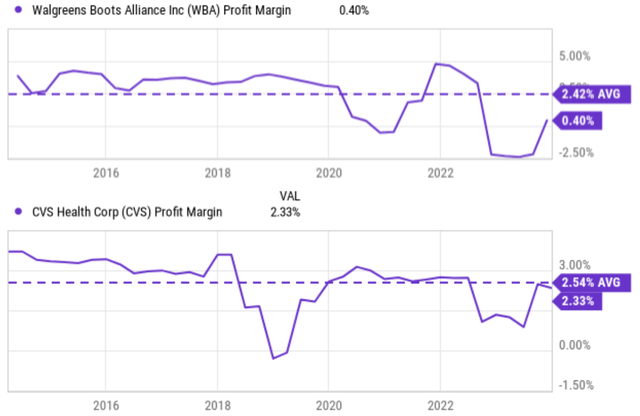

Expanding the horizon a bit beyond Q2, the company used to enjoy very competitive profitability, as shown in the next chart. Before 2020, WBA featured a higher profit margin than CVS, with net margins mostly in the 4%-plus range. In contrast, CVS’ net margins have largely been around 3% during those years. However, due to the various headwinds mentioned earlier, its net margin has nosedived since 2020. The current level of 0.4% is both far below CVS and its own long-term average.

Seeking Alpha data

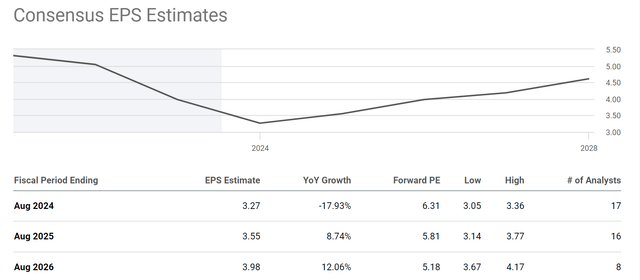

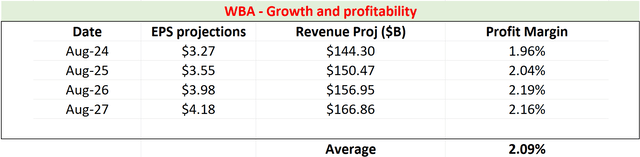

Due to the profitability headwinds, the stock’s P/E is currently extremely compressed. As seen in the next chart, it’s priced at an FY1 P/E of around 6.3x only. My experience is that a P/E at this level is only for terminal stocks – those stocks that will not grow ever. This is not the case for WBA. According to consensus estimates, WBA is projected to grow both its top and bottom lines at a healthy rate (in my view anyway). To wit, EPS is projected to grow from $3.27 in 2024 to $3.98 in 2026, translating into an average annual growth rate of about 10%. Revenues (see the second chart below) are projected to grow from $144B in 2024 to $168B in 2027, translating into an average annual growth rate of 5.3%.

What’s more insightful to me is the profitability margin implied by these projections, as shown in the second chart below. Based on the above bottom and top-line projections, the last column in the chart shows the net margin implied. As shown, these projections imply a net margin on average of 2.09%, which is very achievable in my view considering peer averages, its past performance, and the many initiatives undergoing at WBA as aforementioned.

Seeking Alpha data Author based on Seeking Alpha data.

Other Risks and Final Thoughts

All told, WBA is more of a high-risk and high-payoff investment opportunity. Besides the risks mentioned above, WBA also faces a range of risks common to the healthcare sector and also some risks more particularly to its own business model and exposure. The pharmacy retail industry is highly competitive, with players like CVS, Walmart, and Amazon vying for market share. Price wars and competition for generic drug contracts can squeeze profit margins. The pharmacy retail industry is heavily regulated by government agencies. Changes in regulations regarding reimbursement rates, drug pricing, and online pharmacy sales can impact profitability. For WBA, it has a significant international presence, particularly in Europe, which could further compound some of these risks. Such an international presence exposes the company to currency fluctuations and economic uncertainties in foreign markets, and also complicates the regulation risks.

Although my overall conclusion is that the current sentiment has swung too far in the fear direction and WBA now presents an attractive contrarian opportunity. The current valuation is so compressed that I believe all the negatives have been priced in while the positives are largely ignored.

Read the full article here