Wells Fargo (NYSE:WFC)’s second-quarter earnings release highlighted the bank’s value as an attractive capital return play. Wells Fargo beat top and bottom line estimates in the second-quarter, as did Bank of America (BAC), reported only a small decline in its net interest margin and announced that it wants to increase its third-quarter dividend by a massive 17%. The bank also bought back a ton of its shares in the second-quarter. Although shares of Wells Fargo have fully recovered first-quarter valuation losses and now trade at an 8% premium to book value, I believe Wells Fargo represents value for dividend investors. Given that the bank is set to return more cash to shareholders going forward and the dividend raise for Q3’23 is generous, I continue to see WFC as a strong buy!

Strong earnings sheet for Q2

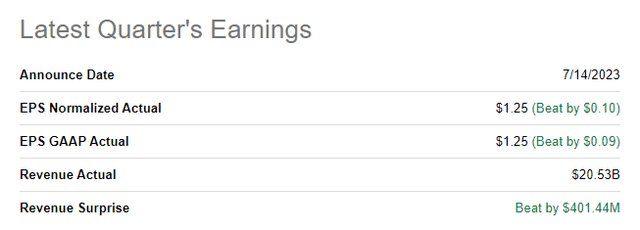

Wells Fargo reported a top and the bottom line beat for the second-quarter: the bank generated Q2 revenues of $20.53B, beating estimates by more than $400M. Earnings per-share were $1.25 which beat the consensus estimate by $0.10 per-share.

Source: Seeking Alpha

Net interest margin decline

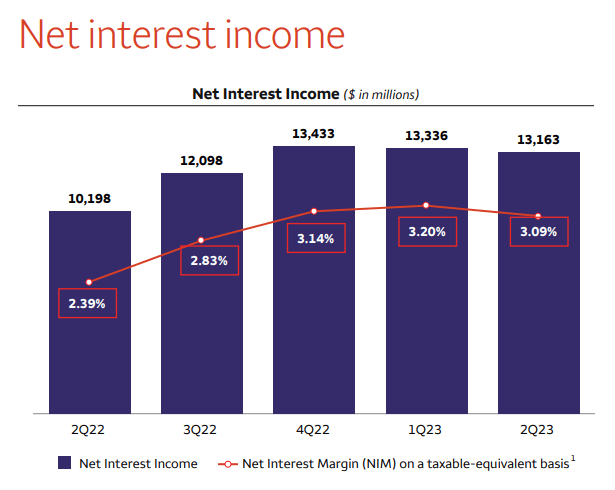

Wells Fargo reported a net interest margin of 3.09% for the second-quarter, showing a 0.11% decline quarter over quarter. Nonetheless, the bank benefited from solidly growing net interest income compared to the year-earlier period: it booked $13.16B in net interest income, showing almost $3.0B year over year growth. Bank of America also saw a significant increase in its net interest income compared to Q2’22 as banks are primary beneficiaries of the Fed’s interest rate increases.

Source: Wells Fargo

Wells Fargo’s deposit situation

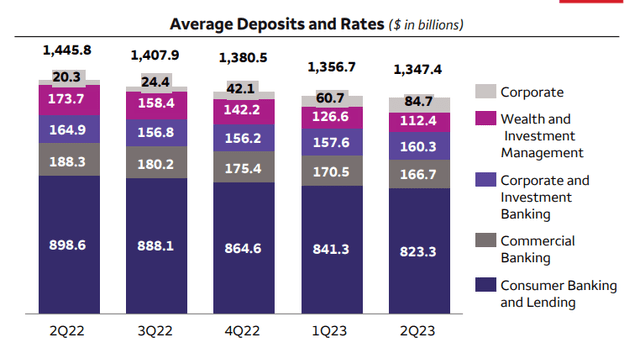

Wells Fargo’s deposit trend in the second-quarter remained slightly unfavorable as the bank saw a 1% decline quarter over quarter. Average deposits at the end of Q1’23 totaled $1,347.4B and Q2’23 marked the fourth consecutive quarter of shrinking deposits within the last year. The reason for this is well-understood: by depositing cash into low-yielding bank accounts depositors and savers lose out on returns and in response to a changing interest rate landscape, they have started to move cash over to higher-yielding investments. I don’t expect this trend to stop, obviously, as long as the Fed increases interest rates and low-yielding bank deposits remain an uncompetitive investment choice for savers.

Source: Wells Fargo

Why Wells Fargo is now chiefly a capital return play

I recommended Wells Fargo in June, citing an undeserved discount to book as a reason to buy shares. Now, with the bank trading at its pre-crisis valuation again, buying WFC at a discount to book value is no longer possible. However, the commercial bank gives investors, especially those focused on generating income, a good reason to buy into the bank nonetheless: Wells Fargo said in its Q2 earnings sheet that it is looking forward to increasing its Q3 dividend to $0.35 per-share, which would represent an increase of 17% over the Q2 dividend of $0.30 per-share. This means that Wells Fargo offers dividend investors a 3.0% FWD dividend yield.

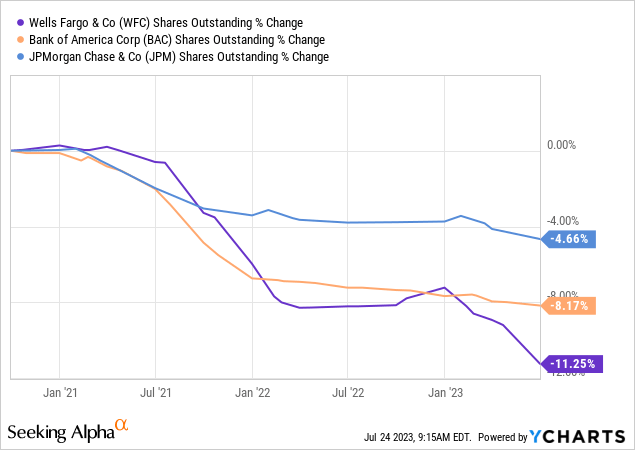

On top of the generous dividend increase, the bank is returning a lot of cash to shareholders via its stock buybacks. In the second-quarter, Wells Fargo repurchased 100M shares for a total consideration of $4.0B. Wells Fargo retires its share count at a very aggressive pace and no other top tier bank reduces its outstanding shares as quickly as Wells Fargo.

Commercial real estate is a potential risk factor

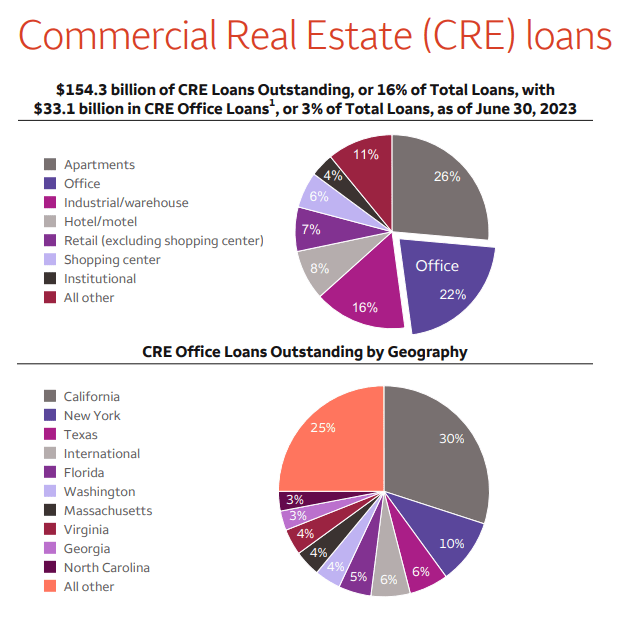

One problem that I see with Wells Fargo is that the commercial bank has considerable exposure to the commercial real estate sector. As the second-largest bank in the country, after JPMorgan Chase (JPM), and with a national branch footprint, Wells Fargo has made considerable investments in the U.S. real estate sector through its loan operations.

Wells Fargo lent a total of $154.3B to the commercial real estate sector. Within this commercial real estate loan portfolio, $33.1B was invested in the office market, representing a rather high share of 22%. Only residential loan investments (apartments) had a higher loan share of 26%. The office market experiences a number of headwinds right now, including foreclosure challenges, which potentially indicates growing credit risks for Wells Fargo.

Source: Wells Fargo

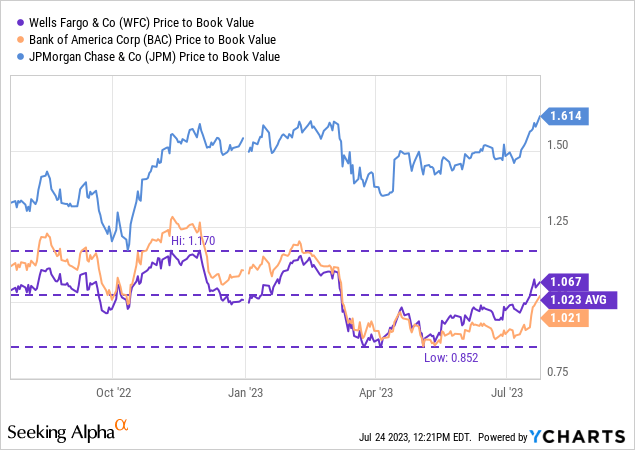

Wells Fargo: no longer discount value

Wells Fargo is no longer trading at a discount to book value and the bank’s valuation has been restored to its pre-crisis valuation level. While the discount valuation was a good reason to buy Wells Fargo in the past, the rationale to own Wells Fargo is now driven chiefly by the bank’s potential to return mor capital to shareholders, in my opinion.

Bank of America is now also trading at a small premium to book value and I recommended the bank as a strong buy after its Q2 results due to its net interest income potential, cheap valuation and good loan quality.

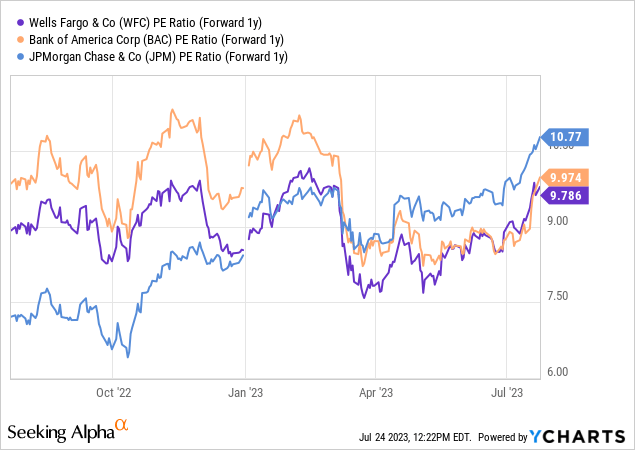

However, Wells Fargo is a bargain based off of P/E. Since Wells Fargo trades at less than 10X FWD earnings, is a solidly profitable and its earnings should continue to grow in the long term, I consider WFC to have an attractive risk profile. Applying an earnings multiplier factor of 12-13X, Wells Fargo could have a fair value in a range of $57-62 per-share.

Risks with Wells Fargo

The contraction of Wells Fargo’s net interest margin as well as the declining deposit base are headwinds, but they are not unique to Wells Fargo and manageable in the long term. A much bigger risk, at least in the short term, is Wells Fargo’s exposure to the commercial real estate sector. Given the large size of Wells Fargo’s loan book, the bank is vulnerable to deteriorating fundamentals in the commercial real estate market.

Closing thoughts

Wells Fargo saw a 1% Q/Q decline in its deposit base in Q2’23, a marginal contraction in its net interest margin, it retained considerable CRE loan exposure and shares are no longer a bargain based off of P/B. Nonetheless, there are benefits of investing in WFC, in my opinion: the bank is buying back stock as a fast pace and it proposed a very generous increase in the bank’s Q3’23 dividend. Wells Fargo has been excellent in retiring shares, relative to other top tier banks, and I see the bank now chiefly as a capital return play. With a FWD dividend yield of 3.0%, shares of Wells Fargo should continue to appeal to dividend investors!

Read the full article here