Earnings of Westamerica Bancorporation (NASDAQ: NASDAQ:WABC) will most likely decline this year because of a lackluster growth of the balance sheet and a decline in the net interest margin. Overall, I’m expecting the company to report earnings of $5.40 per share for 2024, down 10.8% year-over-year. My valuation analysis shows that the market has overreacted to the prospects of an earnings dip this year. There may be some money to make here as the price corrects and gets closer to its fair value. As a result, I’m adopting a buy rating on Westamerica Bancorporation.

Expecting a Stable Balance Sheet

Although WABC’s loan portfolio continued to decline in the first quarter, the company managed to increase its asset size during the quarter. This is quite an achievement as the asset size has been decreasing for the last two years.

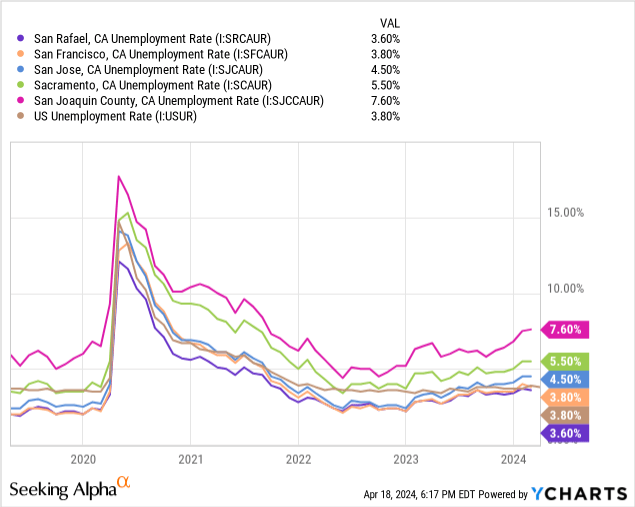

However, I don’t think the balance sheet can continue to grow at the first quarter’s rate in the year ahead because the operating environment continues to be challenging. Westamerica Bancorporation mostly operates in Northern and Central California, from Mendocino, Lake, and Nevada Counties in the north to Kern County in the south. Unemployment rates in the major cities and counties in Northern and Central California have been trending upward in recent months and are mostly worse than the national average, as shown below.

As a result, I think the balance sheet size will likely remain mostly unchanged for the remainder of this year. Further, I believe that loans will increase while securities will decrease because of the anticipated interest rate trend. I’m expecting the Fed funds rate to dip by 50-75 basis points this year, which will increase the demand for loans.

Overall, I’m expecting the loan book to grow by 1.2%, and securities to dip by 2.9% in 2024. The following table shows my balance sheet estimates.

| Financial Position | FY19 | FY20 | FY21 | FY22 | FY23 | FY24E |

| Net Loans | 1,107 | 1,232 | 1,045 | 938 | 850 | 860 |

| Growth of Net Loans | NA | 11.3% | (15.2)% | (10.2)% | (9.4)% | 1.2% |

| Other Earning Assets | 3,817 | 4,579 | 4,945 | 5,248 | 4,878 | 4,830 |

| Deposits | 4,813 | 5,688 | 6,414 | 6,225 | 5,474 | 5,315 |

| Borrowings and Sub-Debt | 31 | 103 | 146 | 58 | 58 | 254 |

| Common equity | 731 | 845 | 827 | 602 | 773 | 964 |

| Book Value Per Share ($) | 27.1 | 31.3 | 30.8 | 22.4 | 28.9 | 36.1 |

| Tangible BVPS ($) | 22.5 | 26.8 | 26.2 | 17.8 | 24.4 | 31.6 |

| Source: SEC Filings, Earnings Releases, Author’s Estimates(In USD million unless otherwise specified) | ||||||

Further Margin Compression Likely

After a growth of 120 basis points last year, the net interest margin shrank by 11 basis points in the first quarter of 2024. I think the margin can continue to slip in the year ahead because funding costs are stickier than asset yields. The funding costs are downward sticky because WABC has a very low-cost deposit base. In fact, the company’s funding cost was just 0.22% during the first quarter of the year. As a result, it can’t fall much lower when interest rates start declining this year.

The average asset yield will likely dip this year because of loans, which make up around 15% of the company’s total earning assets. I’m expecting the Fed funds rate to decline by 50-75 basis points this year. As a result, I’m expecting the net interest margin to dip by around six basis points in the last nine months of 2024.

Expecting Earnings to Dip Because of a Negative Outlook on the Margin and Balance Sheet

I’m expecting the earnings of Westamerica Bancorporation to decline this year because the earning assets will most probably dip. Additionally, the net interest margin will likely trend downwards, which will hurt earnings. My margin and balance sheet estimates (discussed above) lead to a net interest income of $261 million. Further, I’m expecting that the declining trend for non-interest income will continue and the non-interest expense will continue to grow at a normal rate. For provisioning expenses, I’m expecting the first quarter’s rate to continue.

These assumptions lead to an earnings estimate of $5.40 per share for 2024, down 10.8% year-over-year. The following table shows my income statement estimates.

| Income Statement | FY19 | FY20 | FY21 | FY22 | FY23 | FY24E |

| Net interest income | 157 | 164 | 171 | 220 | 280 | 261 |

| Provision for loan losses | – | 4 | – | – | (1) | 1 |

| Non-interest income | 47 | 46 | 43 | 45 | 44 | 41 |

| Non-interest expense | 99 | 99 | 98 | 99 | 103 | 106 |

| Net income – Common Sh. | 80 | 80 | 87 | 122 | 162 | 144 |

| EPS – Diluted ($) | 2.98 | 2.98 | 3.22 | 4.54 | 6.06 | 5.40 |

| Source: SEC Filings, Earnings Releases, Author’s Estimates(In USD million unless otherwise specified) | ||||||

Risks Attributable to the Securities Portfolio

Because most of Westamerica Bancorporation’s assets are in securities, the unrealized mark-to-market losses on the Available-For-Sale securities portfolio are the biggest source of risk. These unrealized losses amounted to $271.5 million at the end of December 2023, which is around 34% of the total equity book value, according to details given in the 10-K filing. (Note: this figure isn’t available yet for the March-ending quarter.

Apart from the unrealized mark-to-market losses on securities, Westamerica Bancorporation’s risk level appears subdued. Non-performing loans made up just 0.18% of total loans at the end of March 2024, as mentioned in the earnings release.

WABC is Offering a Dividend Yield of 3.8%

Westamerica Bancorporation is offering a dividend yield of 3.8% at the current quarterly dividend rate of $0.44 per share. Despite the negative earnings outlook, I think the dividend payout is secure. The earnings and dividend estimates suggest a payout ratio of 32.6% for 2024, which is much below the five-year average of 45%. Moreover, the company is well-capitalized, therefore, there is barely any chance that regulatory requirements would force a dividend cut. The company reported a total capital ratio of 15.64% for the end of December 2023 as opposed to a minimum regulatory requirement of 10.50%. (This ratio hasn’t been updated for the March-ending quarter as yet.)

WABC Appears Undervalued

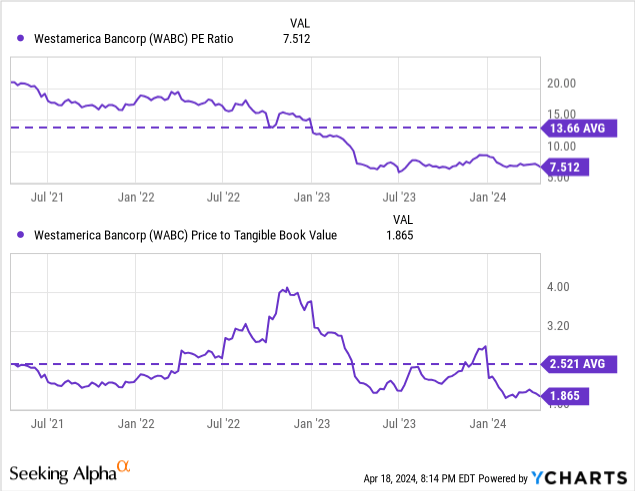

Historical analysis shows that WABC is currently trading at a big discount to its historical multiples.

As the historical multiples appear a bit high, I’ve decided to use the peer average price-to-tangible book (“P/TB”) and price-to-earnings (“P/E”) multiples to value Westamerica Bancorporation. Peers are trading at an average P/TB ratio of 1.38 and an average P/E ratio of 10.8, as shown below.

| WABC | NBHC | HOPE | BUSE | SYBT | Average | |

| P/E (“ttm”) | 7.52 | 8.82 | 9.39 | 10.03 | 11.71 | 9.99 |

| P/E (“fwd”) | 8.56 | 10.1 | 9.85 | 10.64 | 12.74 | 10.83 |

| P/TB (“ttm”) | 1.81 | 1.46 | 0.76 | 1.32 | 1.96 | 1.38 |

| P/B (“ttm”) | 1.57 | 1.02 | 0.59 | 0.95 | 1.47 | 1.01 |

| Source: Seeking Alpha | ||||||

Multiplying the average P/TB multiple with the forecast tangible book value per share of $31.6 gives a target price of $43.4 for the end of 2024. This price target implies a 7.2% downside from the April 19 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 1.18x | 1.28x | 1.38x | 1.48x | 1.58x |

| TBVPS – Dec 2024 ($) | 31.6 | 31.6 | 31.6 | 31.6 | 31.6 |

| Target Price ($) | 37.1 | 40.3 | 43.4 | 46.6 | 49.7 |

| Market Price ($) | 46.8 | 46.8 | 46.8 | 46.8 | 46.8 |

| Upside/(Downside) | (20.7)% | (13.9)% | (7.2)% | (0.4)% | 6.3% |

| Source: Author’s Estimates |

Multiplying the average P/E multiple with the forecast earnings per share of $5.40 gives a target price of $58.5 for the end of 2024. This price target implies a 25.2% upside from the April 19 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 8.8x | 9.8x | 10.8x | 11.8x | 12.8x |

| EPS 2024 ($) | 5.40 | 5.40 | 5.40 | 5.40 | 5.40 |

| Target Price ($) | 47.7 | 53.1 | 58.5 | 64.0 | 69.4 |

| Market Price ($) | 46.8 | 46.8 | 46.8 | 46.8 | 46.8 |

| Upside/(Downside) | 2.0% | 13.6% | 25.2% | 36.7% | 48.3% |

| Source: Author’s Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $51.0, which implies a 9.0% upside from the current market price. Adding the forward dividend yield gives a total expected return of 12.7%. As Westamerica Bancorporation appears undervalued, I’m adopting a buy rating on the stock.

Read the full article here