Co-authored with Treading Softly

A friend texted me the other day and asked me how I was doing – I hope you have friends who are like this. Just out of the blue, reach out and check in on you.

The older I get, the more I learn to appreciate those friendships that don’t require a lot of maintenance to still be exceptionally important and deep. They asked me another question as a follow-up later on in the day after more conversation about this coming recession that everyone endlessly talks about. From their perspective, everything seemed fine; people were still out there getting jobs, and the economy was still moving. They were wondering when this recessionary shoe was going to fall – proverbially speaking – and what they should do about it.

Now being my friend, they should know that I’m going to recommend, as any professional income investor would do, that they shore up their income portfolio with stable, strong income-providing picks. This way, they can weather any potential recessionary storm that may come. The question then becomes, what kind of income pick is the most stable and storm resistant?

Many people believe that we are seeing a Y-shaped recovery, meaning that the wealthiest among us are seeing all the recovery while the middle and lower classes are seeing no real recovery from the prior inflationary pressures that were occurring. Yet should you buy investments that specifically pay you income while catering to the wealthiest? You don’t want to be caught with your pants down when the winds change – you just have to ask Silicon Valley Bank investors about that.

What I like to do is find income from the most “boring” places possible. This is why I own the gas pump and I own the power utility. Today, I want to look at an investment opportunity where you can own everyday shopping stores – not the store itself, but the land. So the store becomes your client while they’re selling basic necessities and goods to everyday people.

Let’s dive in!

Own the Land. Get Paid by the Store.

Realty Income Corporation (NYSE:O), yielding 4.9%, is one of the oldest publicly-traded REITs and is known as “The Monthly Dividend Company.” O has declared 636 consecutive monthly dividends and has increased its dividend for 103 consecutive quarters. O is, perhaps, the best example of the power of compounding income.

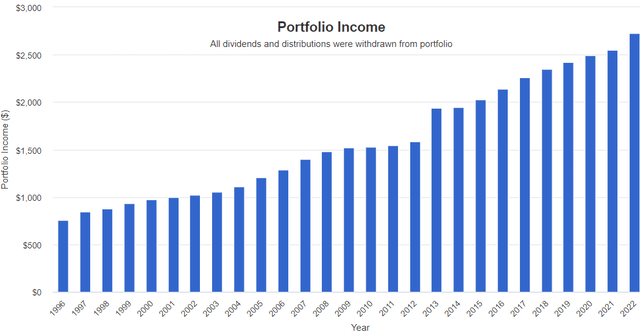

From 1996 through 2022, the income received by an investment in O increased 360%, and that is assuming that you didn’t reinvest a single penny – you spent all of that income. Source

Portfolio Visualizer

To put that in context, inflation over the same period was 195%. Your money, doing all the work to bring in even larger amounts of money in the future. Furthermore, this was accomplished through two recessions and a few black swans events.

O has achieved this success by taking a straightforward business model and executing it well. O is a landlord of a portfolio that has grown to nearly 12,500 properties in the U.S. and Europe.

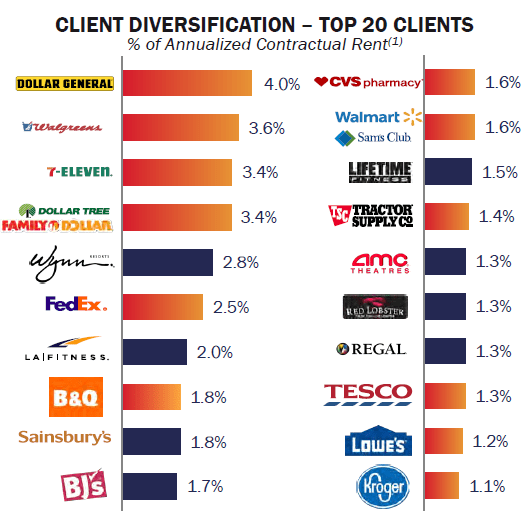

O owns gas stations, dollar stores, pharmacies, grocery stores, and a whole lot more. It buys the real estate and leases to the tenant, making most of its money from rent over many years. You likely recognize the brands of O’s tenants. Source

Realty Income Q1 Presentation

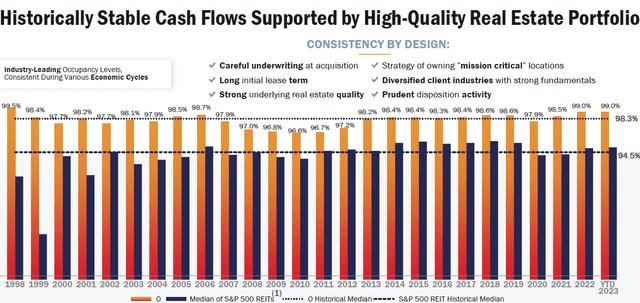

By maintaining an average lease term of nearly 10 years, O has historically experienced very stable occupancy and rental income. Even during the depths of the Great Financial Crisis, occupancy remained above 96%.

Realty Income Q1 Presentation

O’s success is likely to continue as it benefits from its growing scale. O has an A3 credit rating from Moody’s and an A- rating from S&P, providing it relatively cheap access to capital compared to peers. It flexed that muscle recently by issuing €1.1 billion in unsecured notes in two tranches with an average yield of 5.08%. At the same time, O has bought $2.6 billion in real estate at an average cash capitalization rate of 6.8%.

O has the expertise, and the financial muscle, to raise capital and invest it for solid returns even in this environment. O keeps growing, buying property every quarter and turning rent into dividends. Watch your income grow like a weed with O!

Conclusion

When a recession starts knocking on your door, you do not have time to make adjustments. It’s like an unexpected house guest – either you have a guest room prepared, or you don’t.

For most Americans, they don’t have a large savings account or emergency fund that can allow them to be buffered against the worst that could occur. Most can’t afford the loss of a job because of outsourcing or a slowdown in the economy. Even the wealthiest among us are able to see financial hits that cause them to stop their lavish spending.

However, in the midst of even the deepest recessions, the “lipstick phenomenon” is exceptionally powerful. This phenomenon is well documented in the sense that even in recessionary environments, everyday people will still spend money on luxury goods to reward or treat themselves. But as the recession is worsening, the price that they’re willing (or able) to pay goes down. So while they may not buy the most expensive meal at a restaurant, they’re still willing to pick up makeup and make themselves feel pretty.

As an income investor and one who is no longer a novice but a professional income investor, you want to be able to look at the economy and the market, anticipating what might happen and positioning your portfolio to benefit. We help with this by providing weekly market outlooks that take a look at the economy from a global perspective and show how we’re aligning our Model Portfolio to benefit or to survive and not be impacted negatively.

Today one simple step you can take is to buy shares of O. They own the land on which so many stores operate, providing the basic and bare essential necessities as well as options for those consumers who want to participate in the lipstick phenomenon to spend a little extra on luxury goods. Because these stores aren’t going anywhere, even during a recession, O will continue to pay you, ensuring that your retirement income stream never stops. You can have financial freedom and financial security even in the heart of a recession.

That’s the beauty of my Income Method. That’s the beauty of income investing.

Read the full article here