The bond market is as exciting as it has ever been, especially for those seeking active returns. By looking at the asset class, our latest observation includes the PIMCO 25+ Year Zero Coupon U.S. Treasury Index Exchange-Traded Fund ETF (NYSEARCA:ZROZ), a long-term zero-coupon bond vehicle managed by the renowned PIMCO.

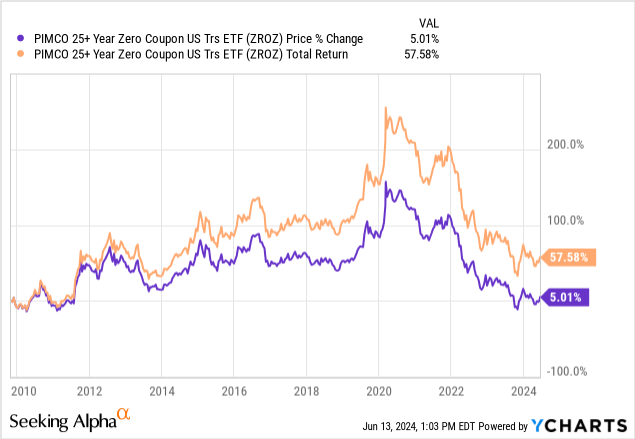

Our draw to this asset stems from its bullet structure, which introduces a debate regarding price fluctuations. Moreover, the ZROZ ETF has shed nearly 15% of its value in the past year, providing us the opportunity to communicate with concerned investors and/or those looking to enter new positions.

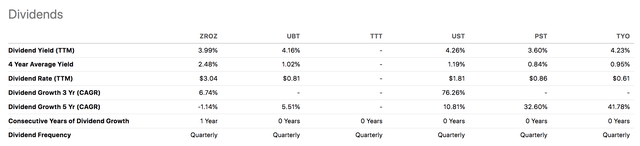

ZROZ ETF Return (Seeking Alpha)

Without further ado, here are our key findings on ZROZ ETF.

What Is ZROZ ETF?

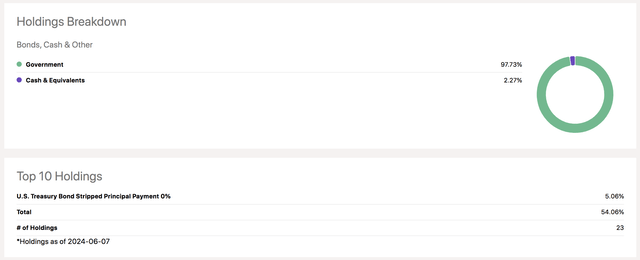

ZROZ ETF is a zero-coupon 25-year+ ETF, which means it invests in bonds with maturity dates above 25 years and no coupons. However, despite investing in bullet-structured bonds, the vehicle pays a quarterly distribution, which currently has a 12-month trailing yield of 3.99%.

Seeking Alpha

Furthermore, ZROZ ETF tracks the performance of the ICE BofA Long US Treasury Principal STRIPS Index using a representative sampling technique, which concurrently leads to minor tracking errors. However, I outline this so that investors can understand that ZROZ ETF is a thematic fund instead of an alpha-seeking fund. Nevertheless, investors can achieve active returns themselves by rotating this fund (among others) in their portfolios.

Lastly, let’s look at ZROZ’s return composition.

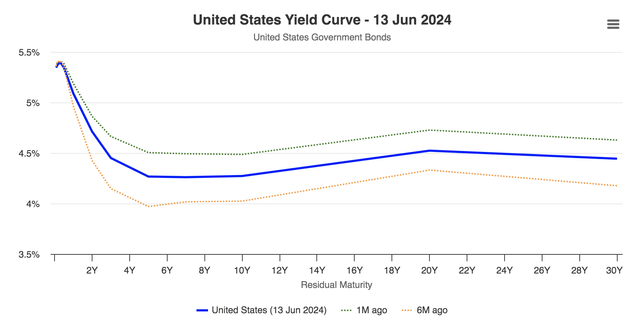

As shown below, ZROZ ETF has an effective duration of 27.70, which means its price usually deviates by 27.7x for a 1% parallel shift in interest rates (remember that treasury prices and interest rates are negatively correlated). Moreover, ZROZ is a dividend-paying asset, which it achieves by selling some of its older zero-coupon bonds, which hold imputed returns, before rotating into newer bonds.

Portfolio Information (PIMCO)

Why We Dislike It At This Time

Duration In A Volatile Interest Rate Environment

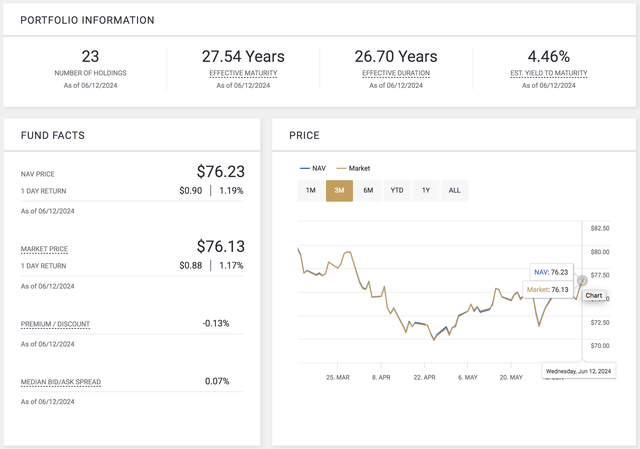

Our first concern is the vehicle’s lengthy duration. We dislike this attribute as we believe the U.S. interest rate environment is highly uncertain; the dispersion of the Fed’s dot plot provides testimony. Such uncertainty can introduce volatility to the interest rate environment concurrently influencing long-duration bonds more than shorter-duration bonds. Sure, volatility can lead to a lower yield curve level, contemporaneously spiking long-duration bond valuations. However, we’d rather not guess where rates will end up at this point in time.

Fed Dot Plot (Bankrate)

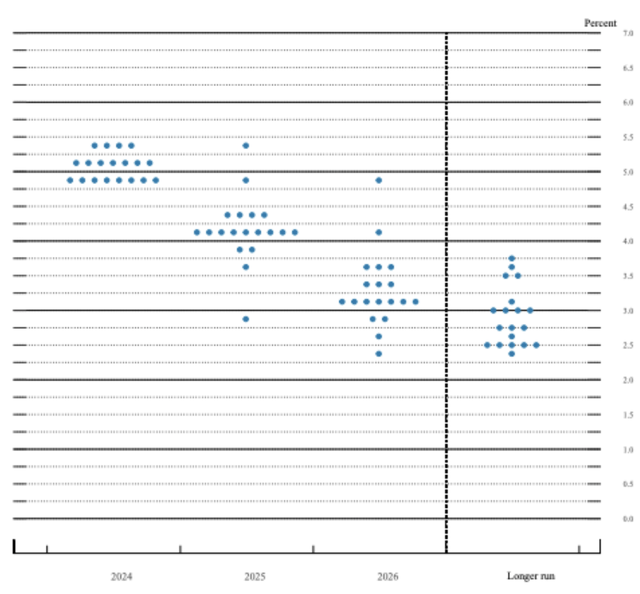

Real economic factors such as volatile consumer sentiment, rising jobless claims, and fluctuating PMI numbers add substance to our aforementioned argument about interest rate volatility. As such, we are concerned by non-parallel shifts in the yield curve, whereby the slope and curvature of the yield curve remain uncertain. Thus, we prefer minimizing bond duration until the potential economically induced twists within the yield curve become clearer.

worldgovernmentbonds.com

In essence, we think the interest rate outlook is very subjective. To our knowledge, the “Fed rate cut” talk has been going on for over a year, and the salient quantitative bond market variables aren’t aligning toward a particular trajectory. As such, we think low-duration assets are better than ultra-long-duration bond vehicles such as the ZROZ ETF.

Risk Premium Outlook

Another consideration is the outlook for systematic treasury bond risk premiums and their potential impact on the ZROZ ETF. We have particular doubts about the illiquidity risk premium, the term premium, and ZROZ’s risk-adjusted return profile.

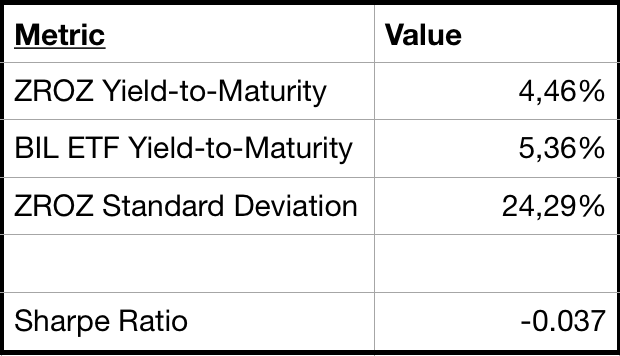

I wanted to open this section by illustrating a risk introduced by the inverted yield curve, which is ZROZ’s Sharpe Ratio. As illustrated below, ZROZ has a negative Sharpe Ratio due to the inverted curve, which has given rise to short-term bond returns and dampened long-term bond expected returns.

Sources: PIMCO & State Street (Author’s Work)

ZROZ’s negative excess return is probably due to investors anticipating a significant drop in short-term yields, which could send short-term bond prices skyrocketing. However, it can also be due to high short-term interest rates delivering stellar income. Regardless of the cause, the data is concerning.

Let’s move along to the illiquidity premium.

The Federal Reserve’s Vice Chair of Supervision spoke back in November 2022 on the issue of bond liquidity, stating that “volatility leads to lower levels of liquidity, which we’re also seeing in Treasury and other markets.”

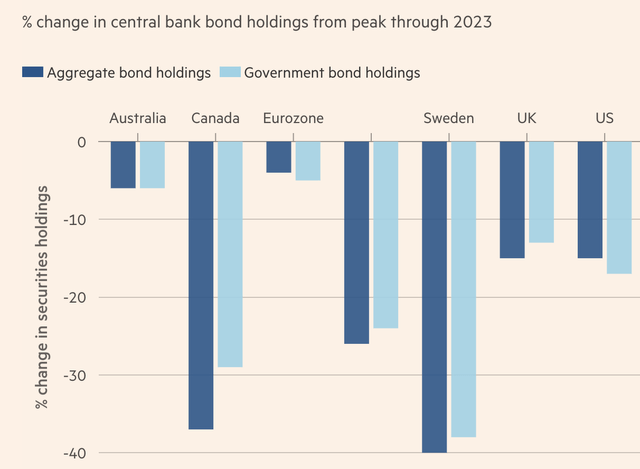

Although time has passed, we think the volatility embedded in today’s interest rate environment somewhat dictates lower bond market liquidity, especially toward the longer end of the maturity schedule. The following diagram illustrates central banks’ bond holdings in March, providing an indication that an additional drain on liquidity has occurred.

Financial Times

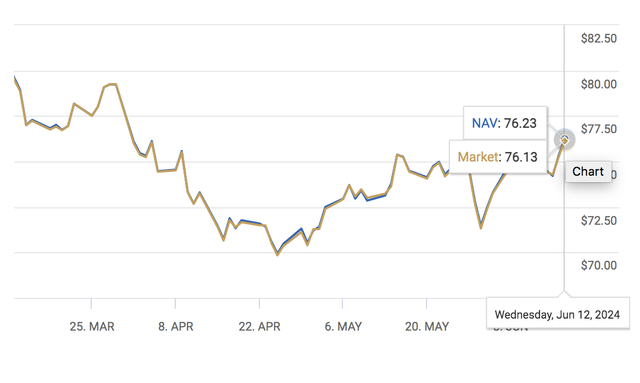

Market illiquidity might justify ZROZ’s current discount-to-net asset value. Moreover, we think the term premium can add exponential problems to the liquidity premium’s stance.

Premium-to-NAV (PIMCO)

As shown in the next diagram, the term premium has increased in recent months, and we believe this trend will continue into the latter stages of 2024, compressing bond valuations. What’s our basis here? Well, the term premium is largely influenced by inflation and/or interest rate uncertainty, which, as discussed before, seems rife.

Federal Reserve Bank of St.Louis

Peer Analysis: Expense Ratio, Dividends

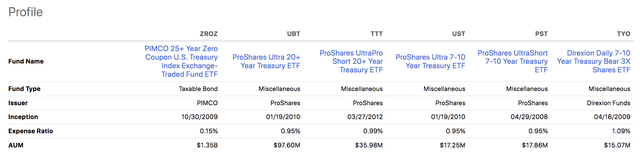

I decided to collate data from other bond funds, such as the ProShares Ultra 20+ Year Treasury ETF (UBT), ProShares UltraPro Short 20+ Year Treasury ETF (TTT), ProShares Ultra 7-10 Year Treasury ETF (UST), ProShares UltraShort 7-10 Year Treasury ETF (PST), and Direxion Daily 7-10 Year Treasury Bear 3X Shares ETF (TYO). Although they have structural differences, some are more or less aligned, while others provide a juxtaposition.

A bird’s eye view suggests that ZROZ’s expense ratio of 0.15% is superb if compared to its peers, especially considering its substantial portfolio size, which can often result in high turnover costs.

Peer Analysis (Seeking Alpha)

A peer view of ZROZ ETF’s dividend yield shows its dividend yield is lower, which isn’t surprising, considering it is a zero-coupon bond ETF, whereas its peers aren’t. Although we think market liquidity will stay low and dent the ETF’s dividend prospects (because imputed returns will be more difficult to obtain), we think its 14 years of consecutive dividend payments prove that it can be an income-generating asset throughout the economic cycle.

Seeking Alpha

Limitations Of The Analysis

In our opinion, the primary risk to this analysis is that it assumes the interest rate environment will be volatile, which won’t necessarily be the case. Interest rates and the bond market are difficult to forecast. As such, we encourage readers to keep this in mind.

Furthermore, much of the analysis is centered on price fluctuations. However, most of ZROZ ETF’s returns have been serviced from dividends, meaning a more in-depth look at its income-generating prospects would be beneficial.

Final Word

Our outlook on the PIMCO 25+ Year Zero Coupon U.S. Treasury Index Exchange-Traded Fund ETF is negative. Although we don’t think the asset is a sell, we believe it would be best to avoid this ETF, given its high duration paired with the uncertain U.S. interest rate environment.

Furthermore, we fear the ETF might be adversely impacted by potential market illiquidity, a rising term premium, and its negative Sharpe Ratio. Although we think the ETF is a sustainable dividend opportunity, its price risk seems extremely elevated.

We hereby assign a Hold rating to ZROZ ETF.

Read the full article here