All eyes are now on underlying inflation. Forget the collapsing energy prices that pushed down overall CPI.

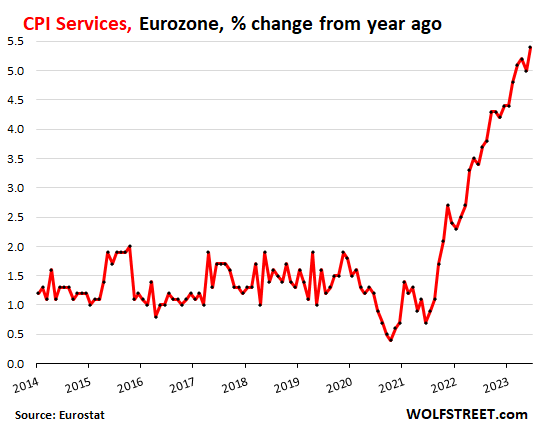

The inflation rate in services in the 20 countries that use the euro spiked to 5.4% in June, compared to a year ago, up from 5.0% in May, a new record in the data going back to 1997, according to Eurostat today, confirming preliminary estimates earlier this month.

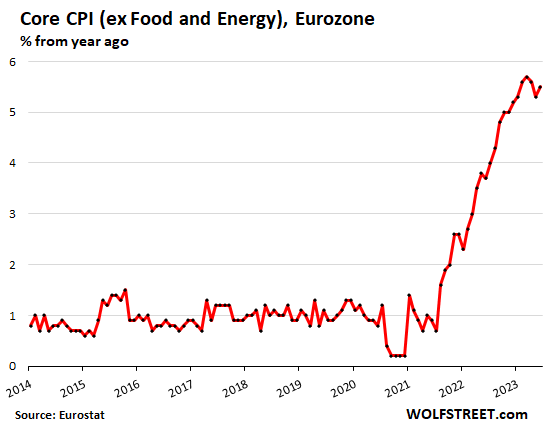

“Core” CPI – without food and energy rose to 5.5%, up from the preliminary estimate for June of 5.4%, and up from 5.3% in May, according to Eurostat. Energy prices have plunged, and food prices, which had spiked horribly, are backing off. But underlying inflation – as measured by core CPI and services CPI – has turned into a stubborn headache.

Services CPI is huge. When inflation gets entrenched in services, it’s hard to dislodge. The majority of consumer spending goes into services: Healthcare, education, housing, insurance, streaming, subscriptions, air fares, lodging, restaurant meals, repairs, cleaning, financial services, haircuts, etc.

There are many services that consumers are having a hard time to comparison-shop, and there are services that are essential to modern life, such as housing and related services, healthcare, etc., which makes it hard for consumers to resist price increases.

“Core” CPI (without food and energy) worsened to 5.5% in June, from the preliminary 5.4% and from 5.3% in May. This was another bad inflation surprise after core CPI had eased off a bit in April and May, and pundits out there had already proclaimed the “peak” of core CPI.

The ECB’s inflation target is 2% pegged on core CPI. So this is not going in the right direction.

Back on June 5, when the May inflation data came out, with core CPI down for the second months in a row, and pundits widely declaring that core CPI had peaked, ECB president Cristine Lagarde came out leaning against this notion of core CPI having peaked.

She told the European Parliament’s Committee on Economic and Monetary Affairs: “Indicators of underlying inflationary pressures remain high and, although some are showing signs of moderation, there is no clear evidence that underlying inflation has peaked.”

And she repeated the ECB’s line that rates would need to be hiked “to levels sufficiently restrictive” to bring inflation down to the ECB’s 2% target, and that the ECB would maintain those rates “for as long as necessary,” she said.

So now there’s a first setback to that “core CPI has peaked” theory, which came with the subtitle that rate hikes wouldn’t be needed anymore.

Overall CPI has been plunging for months because energy prices plunged; the CPI plunged by nearly half, to 5.5% in June, from the energy-price-spike driven peak in October last year of 10.6%. So now overall inflation and core CPI are the same, at 5.5%, with core CPI going up and overall CPI having plunged.

And all eyes are now on core CPI and services CPI to get a sense of underlying inflation, and underlying inflation is now above 5% and heading in the wrong direction.

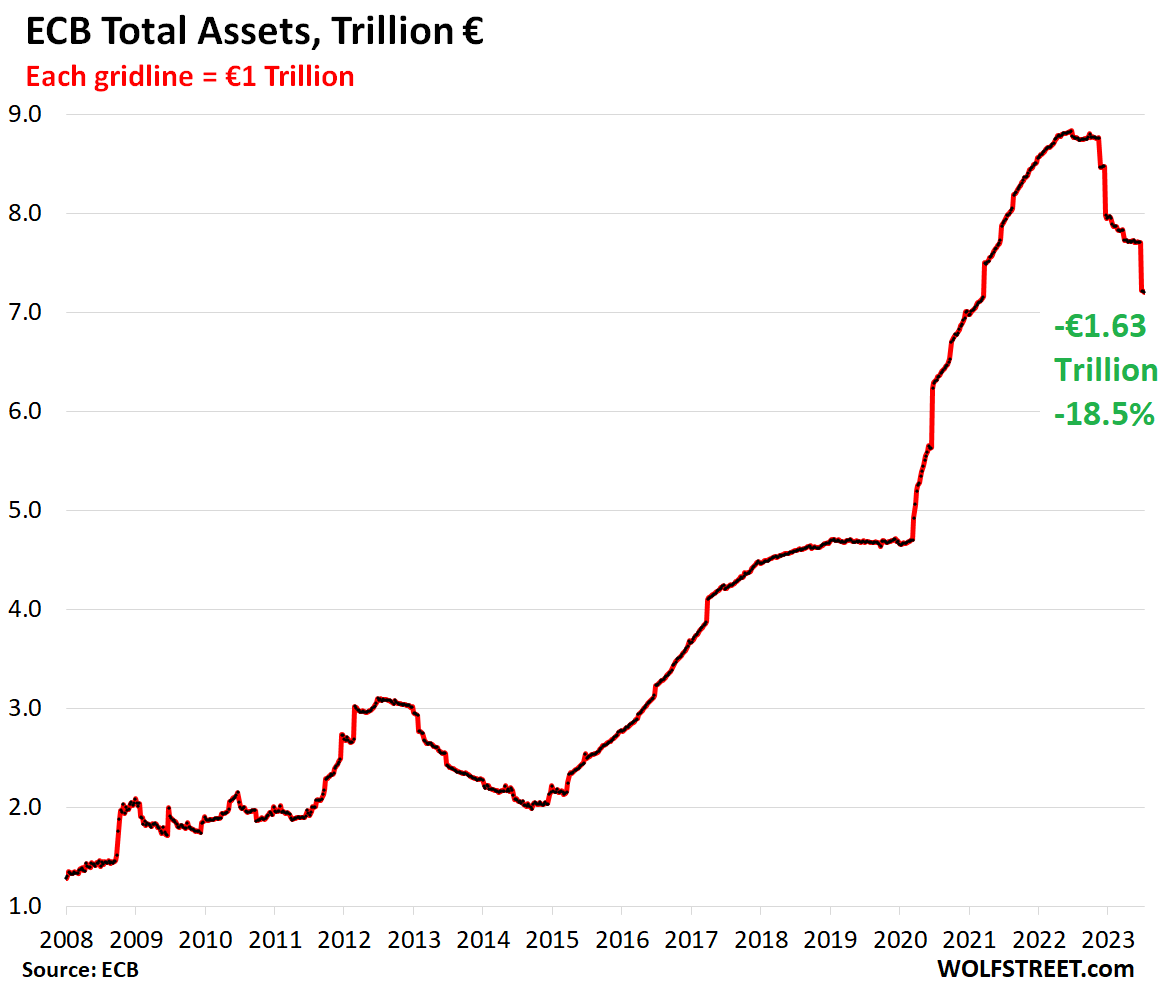

No central banker will publicly admit that crazy money-printing and interest-rate repression over the years added fuel to this inflation fire. They may admit it after they retire from the central bank, but they won’t admit it while still a central banker.

Nevertheless, without admitting anything, the ECB has been unwinding those factors. It hiked its policy rates by 4 percentage points over the past 12 months, from -0.5% to +3.5%, with more rate hikes to come.

And since last November, it has slashed the assets on its balance sheet by €1.63 trillion, or by 18.5%, from €8.84 trillion in June to €7.21 trillion as of the balance sheet released on Tuesday. Of the €4.15 trillion the ECB had piled on during the pandemic, it has now unwound 39%. So that’s a good start:

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here