Criteo (NASDAQ:CRTO) is a global technology company specializing in digital advertising and marketing solutions, primarily in the retargeting business.

Founded in 2005, the company went public in 2013. Share performance has not been exceptional. Trading at ~$34 today, the share price today appears to be at the same level as its IPO price. The stock has also been quite volatile. It reached a 5-year high of ~$45 sometime in 2021 and declined to ~$22 the following year. YTD however, the share price has been up by ~32%.

In this coverage, I am giving CRTO a buy rating. My modeled target price indicates that the stock may present a 17% upside at year’s end.

Catalyst

Except for the temporary headwind that has been depressing ad spend and effectively revenue growth, fundamentals have generally been strong.

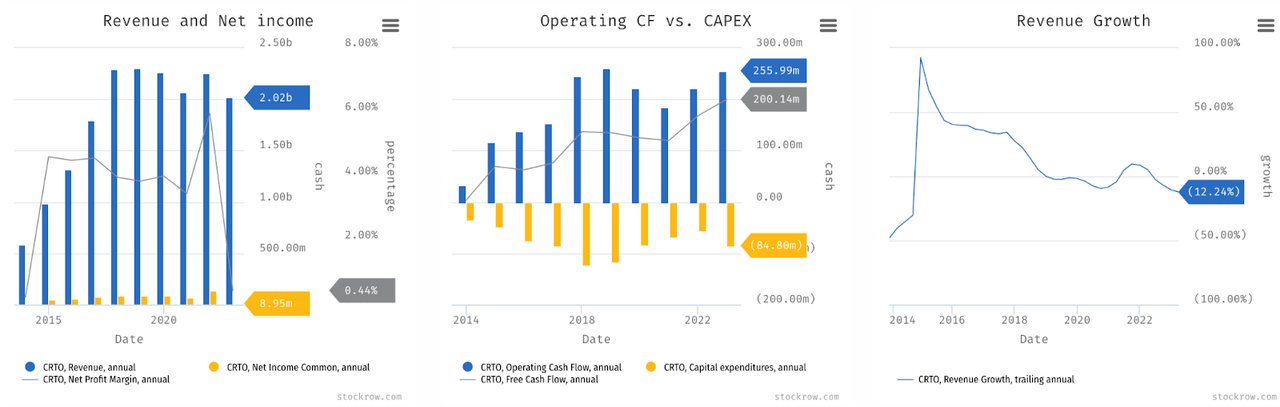

stockrow

CRTO has been a net profitable company with a steady single-digit net margin over the last five years. Likewise, operating cash flow / OCF has been on expansion with steady high single-digit to low teens double-digit margins.

Due to the ongoing macro weakness, net margins have seen quite a contraction to 0.44% and -2.65% in FY 2022 and Q1 2023. Nonetheless, I would still expect a possibility of CRTO regaining a positive net margin in FY 2023. It appears that the net loss of $12 million in Q1 was due to the combined factors of seasonality and one-time non-cash dilution from the Iponweb acquisition. Given the projected strong Q4 and expected $60 million annualized cost saving, profitability for the FY may improve.

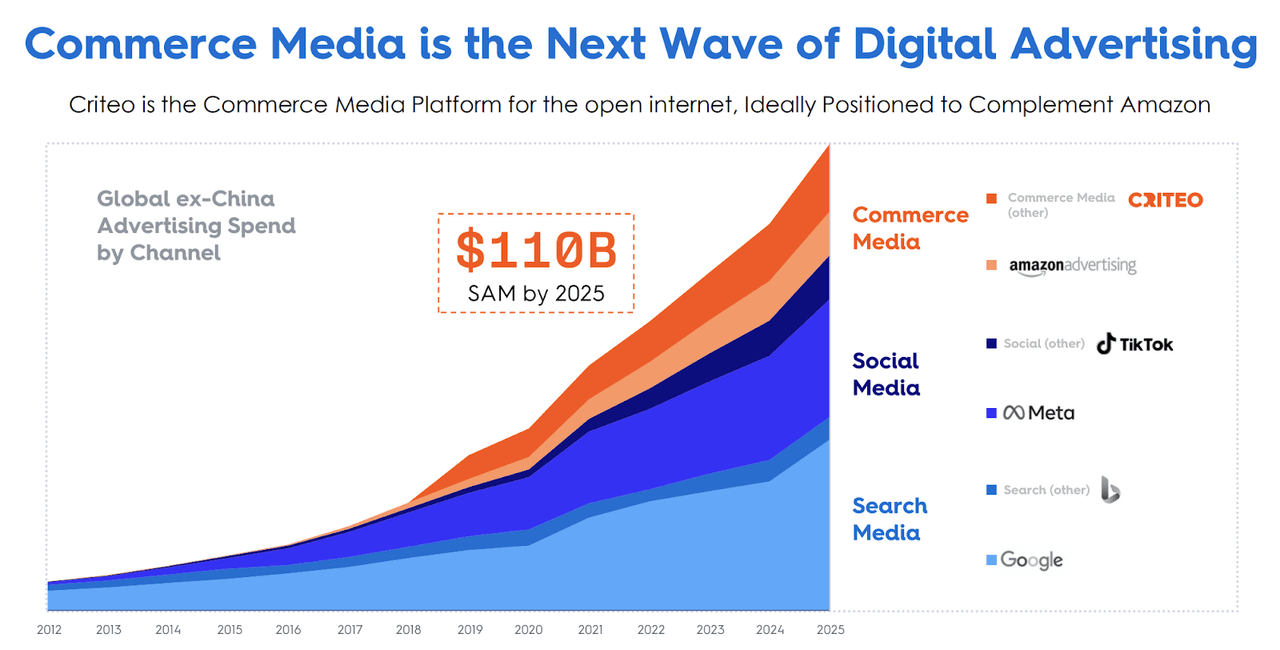

CRTO’s presentation

Longer term, CRTO may also benefit from the Iponweb acquisition to strengthen its ad-targeting capability in the post-cookie world – a situation where regulation around privacy and data collection has resulted in an overall shift from retargeting to cookieless advertising. To capture the trend in commerce media advertising, the baseline strategy involves partnering with offline retailers to capture proprietary first-party data about browsing and shopping behaviors.

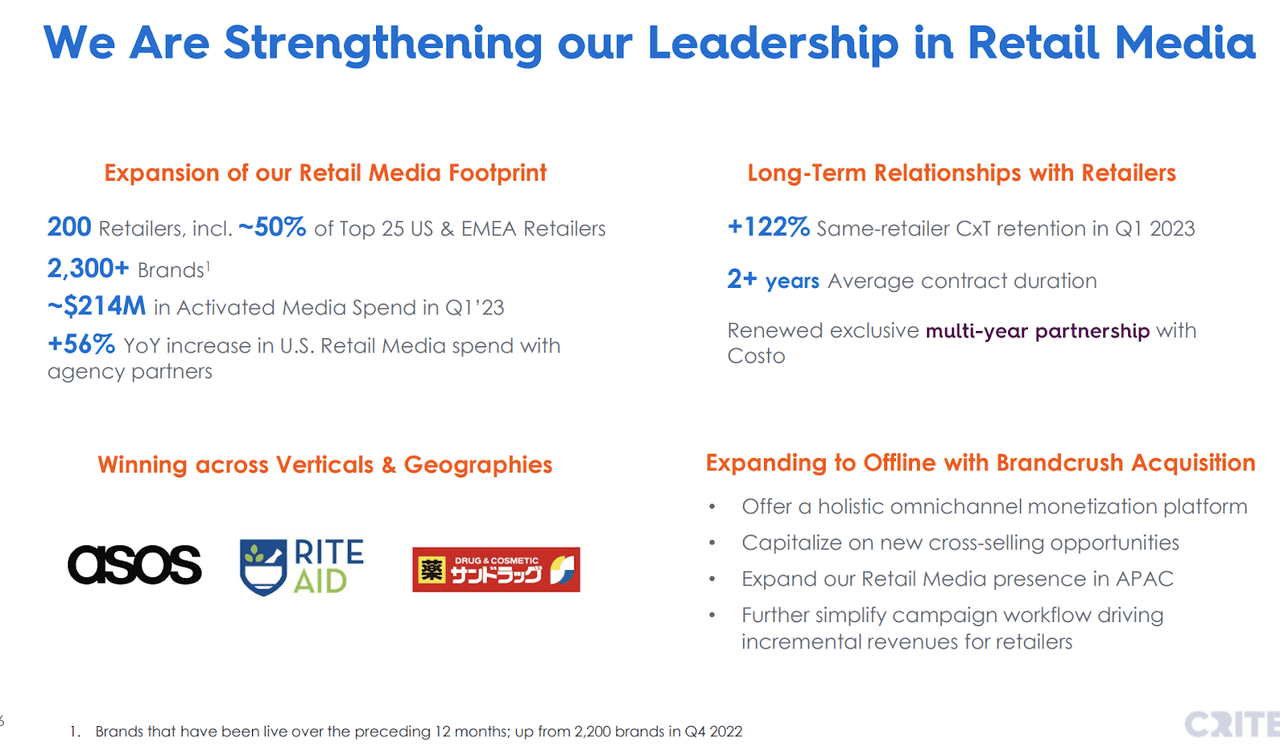

CRTO’s presentation

While the shift may pose a risk to CRTO’s current business, I think that CRTO has made a timely move to capture the new growth opportunity. CRTO continued to see expansion in its retail media footprint in Q1 even during the macro downturn. In particular, the 56% YoY increase in US retail media spending suggests that there is still a lot of room for growth beyond the downturn. Having Iponweb would be highly critical to the overall plan to develop the system that helps scale the commerce media advertising business, given Iponweb’s technical capability and track record in building a sophisticated programmatic ad solution.

Given the effect of COVID-19 and also the macro downturn since last year, we are also not seeing the full potential of the commerce media business just yet. With virtually no debt and a strong balance sheet, CRTO may continue fueling its growth today without any immediate concern and potentially see growth acceleration in the next FY when headwinds subside.

Risk

Though we may see a different situation going forward, CRTO’s performance in creating long-term shareholder value has been underwhelming. While a YTD gain of ~30% is decent, CRTO has a negative 5-year return.

Since the IPO, CRTO has been volatile. Even if we zoom out and look at the all-time return based on the opening price of ~$30 in 2013, the ~13% return does not seem to justify the overall risk in investing in the stock.

Furthermore, while CRTO may have the right assets and resources in place to successfully capture the growth opportunity in cookieless advertising, it is still too early to judge. There was a period between 2017 – 2019 where revenue growth was stagnant and a new CEO, Clarken, was appointed in 2019. However, given the macro challenges from COVID-19 and inflation in the following years, I think that the real test for the new CEO may only begin sometime after the headwinds subside.

Valuation / Pricing

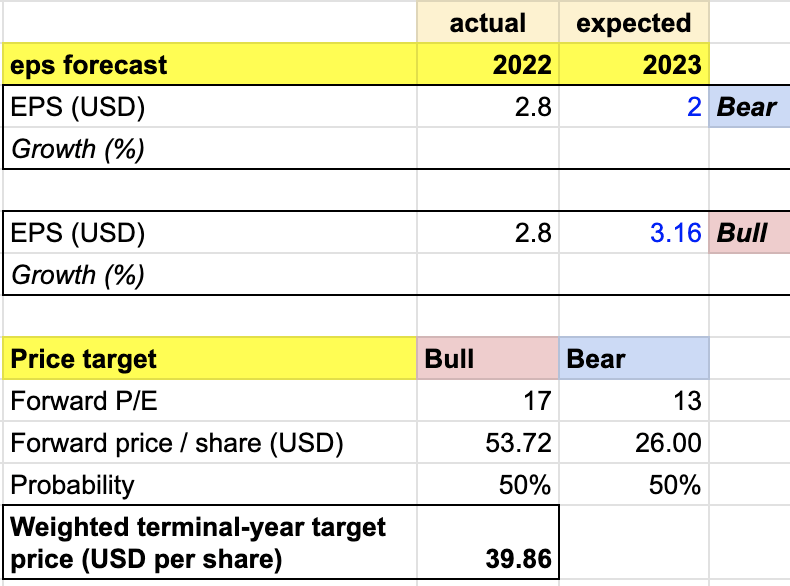

My target price for CRTO is driven by the following assumptions for the bull vs bear scenarios of the FY 2023 target price model:

- Bull scenario (50% probability) assumptions – CRTO to deliver EPS of $3.16, in line with the highest end of the market estimate.

- Bear scenario (50% probability) assumptions – CRTO to deliver EPS of $2, missing the low end of the market estimate.

I assign a P/E of 17x for CRTO under the bull scenario. I think that it is a fair projection. CRTO’s annual P/E has been between 12x – 17x over the last two years, and has also remained quite steady at 17x levels in 2020 and 2021 despite the different circumstances. If CRTO performs according to its expectation and achieves meaningful EPS growth as projected in FY 2023, I would then expect to see a similar outlook to FY 2021. Conversely, I expect a P/E of 13x under the bear scenario, consistent with the market estimates of forward P/E.

author’s own analysis

Consolidating all the information above into my model, I arrived at an FY 2023 weighted target price of ~$40 per share. Since CRTO is trading at $34, the stock appears to offer a 17% upside.

I think that CRTO is a buy at this level. Despite CRTO not providing specific full-year guidance, I consider the overall expectation of solid growth in FY 2023 as a highly bullish sign, especially with the ongoing macro weakness.

Conclusion

Despite a temporary decline in ad spend and revenue growth, the fundamentals of CRTO have remained generally strong. Furthermore, the acquisition of Iponweb could enhance CRTO’s ad-targeting capabilities in a cookieless advertising environment, driven by privacy regulations. However, CRTO’s long-term performance in generating shareholder value has been disappointing, with a negative 5-year return despite a decent year-to-date gain of approximately 30%. There is a likelihood that the situation going forward may be different – the overall expectation of solid growth in FY 2023, considering the prevailing macro weakness, is viewed as a highly positive indication. Based on these factors, I give the stock a buy rating.

Read the full article here