The solar industry is facing one of its greatest challenges in its recent history. Residential rooftop solar installation volumes are falling amid a decline in consumer demand stemming from much higher borrowing costs. Changes in government regulations and subsidies have also created an industry headwind.

Exacerbating the issue is a growing glut of solar modules, as solar panel production from China has risen dramatically over the past three years, spearheaded by companies like Canadian Solar (CSIQ). I detailed this issue in depth in “Canadian Solar: Rising Chinese Production Pushes Global Market Into Glut.”

As demand for solar slows and supply grows, top producers like SolarEdge (SEDG) have lost tremendous value and may be at risk of financial strain due to negative cash-flows. With my view on that company particularly negative, its top competitor, Enphase (NASDAQ:ENPH), deserves closer analysis. Both companies are top producers of microinverters and other critical products for solar projects. The stock has faced a similar decline in its value, with a decrease in its income and sales outlook. That said, if we assume SolarEdge will face more significant issues, then it may be that Enphase will benefit indirectly.

How The Solar Glut Has Impacted Enphase

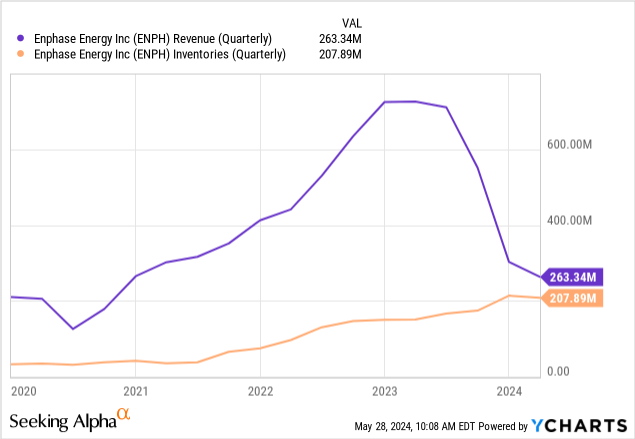

Enphase is following a similar pattern to SolarEdge. Namely, its sales have collapsed while its inventories have risen as the company has seen lower demand for its products. The overall decline in its sales is staggering, likely indicating that it is unwilling to sell all of its inventory as that would push prices below profitable levels. This trend appears to be worsening in recent quarters. See below:

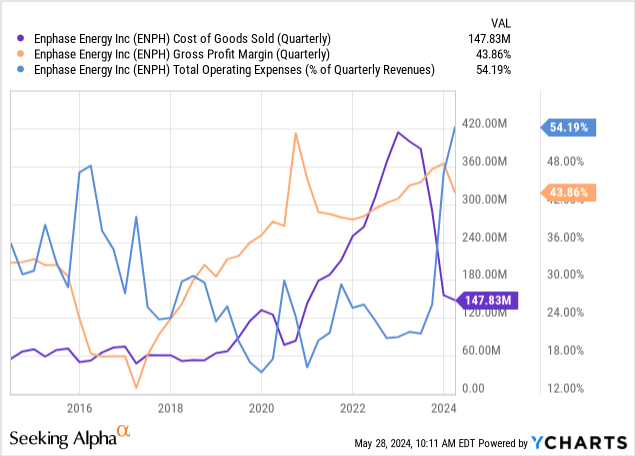

Based on the trends in its COGS, it is clear that the company is looking to lower its production level. Thus, the sharp rise in its inventory should be transitory or will most likely reverse. Its gross margins are stable, telling us that it manages its inventory to keep prices from falling, similar to SolarEdge. Still, its operating costs are not falling proportionally to sales, causing it to account for over half of its quarterly revenue.

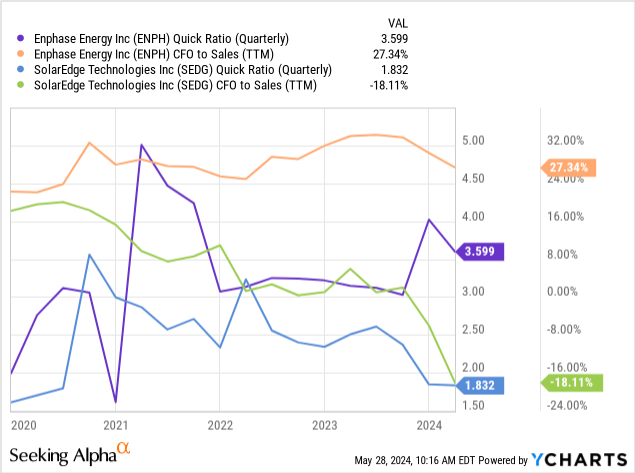

The company can only operate like this for so long before it must either cut prices to sell its products or face greater strain. That said, the company does have a positive cash-flow TTM. Last quarter, it earned $49M in positive CFO, down from around $250M at its 2023 peak, but still far superior to what we see with SolarEdge, which also has a lower quick ratio. See below:

Undoubtedly, both companies are in a tough spot with the dramatic decline in demand. That said, Enphase has a significant advantage, seeing lower declines in its profit margins that ensure its balance sheet should remain relatively stable.

These two companies control around 90% of the US solar inverter market, but Tesla (TSLA) is now looking to expand its position. Interestingly, both companies are seeing inventories rise and sales decline, potentially implying they’re uninterested in complying with the glut in panels that could push prices down below sustainable levels. However, that could give Tesla more room to enter the market.

While Tesla’s solar business is not as large, the company has a market capitalization of ~33X greater, giving it tremendous access to capital that can be used to expand. Tesla claims to be looking to undercut the other two and has superior access to capital to do so. Due to the rate hikes, solar loans now carry interest rates around 5% higher than before 2022, making most customers more price-sensitive. In my opinion, that gives Tesla an edge in taking market share. Still, it’s facing the same issues as the others, seeing installations decline amid lower demand. Thus, I would not necessarily assume Enphase will face immediate competitive pressure from Tesla, only that it’s a looming threat that investors should be mindful of.

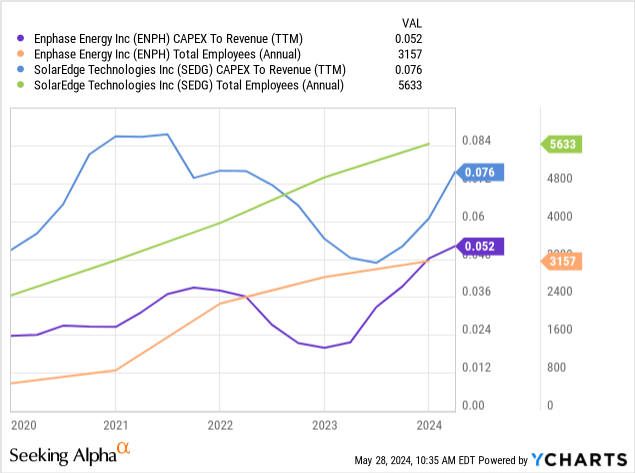

Enphase and SolarEdge are taking different approaches that have impacted their financial situations. Since the market began to slow, Enphase has pared back its employee growth. Enphase’s CapEx-to-sales has risen, but SolarEdge has sustained a higher CapEx investment level. See below:

This data indicates that Enphase is backing off on its growth plans while SolarEdge appears to be maintaining its focus. Enphase’s approach is wiser, as it is not keen on increasing production capacity when demand is dramatically lower and prices are at risk of declining. This difference seems to be reflected in the stark contrast of the two’s cash flows, with Enphase’s balance sheet appearing more sustainable.

What is Enphase Worth Today?

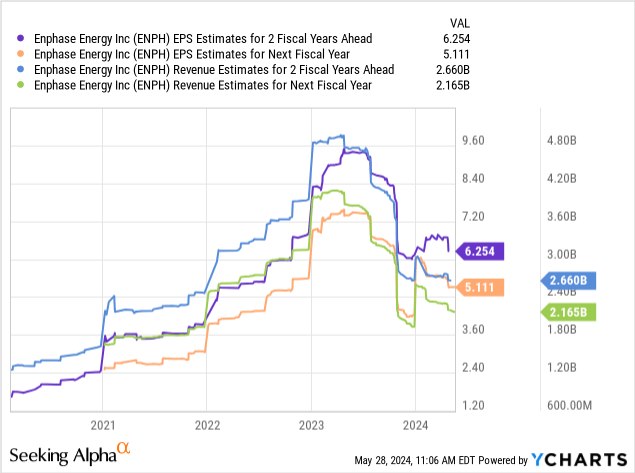

The decline in Enphase’s income and sales is expected to last. It’s one and two-year ahead EPS, and sales outlooks have collapsed since the slowdown began in 2023. Improvement is expected, but the rate of decline should be noted as the expectation trend appears negative. See below:

Based on analyst expectations, Enphase is not expected to see its EPS rebound until 2027 to 2028, which is anticipated to be around ~$7.00 to $9.30 annually. That said, even this year, its EPS is still expected to be positive at $2.90, compared to SolarEdge, which is anticipated to have dramatic losses this year and a slower return to growth.

Of course, these predictions remain somewhat speculative. Much of the market’s trend is controlled by how China reacts in its ongoing effort to increase solar production. Recently, many solar stocks rose dramatically, including Enphase, after China announced that it would crack down on sales at below-cost prices, indicating that the glut should end. Personally, everything posted by China should be taken with a grain of salt, but this may be a positive signal.

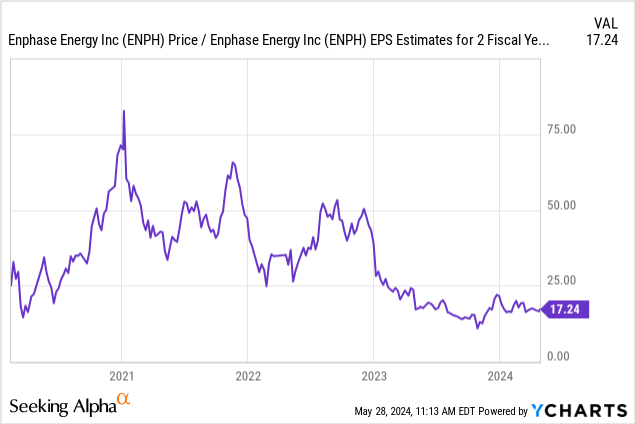

Enphase’s forward “P/E” based on its two-year ahead EPS expectation is ~17.2X today. In my view, that is not a low figure compared to stocks in general. That said, it makes the company notably cheaper than during its high-growth period of 2020-2023. See below:

Since 2023, the decline in its EPS outlook has been proportional to the drop in its stock price. Realistically, a 17X forward “P/E” for a company with relatively high cyclical risk (as we’re seeing now) is slightly high. Enphase is expected to see its EPS rise to over $10 by ~2029. Even then, it is unclear if the company will recover its income within this period. I do not think that is an appropriately considerable discount given its immediate pressures and competitive risks with Tesla. Given the latter’s growing financial pressures, I believe its valuation is more sensible than SolarEdge.

The Bottom Line

I’d prefer Enphase to have a forward “P/E” closer to 12X (on its two-year ahead EPS outlook), equating to a target price of ~$90. That is not necessarily what I expect ENPH to trade at, but the price where I would be bullish. At its current price, I am neutral, but I believe it is slightly overvalued, given the uncertainty in the macroeconomic environment.

In my view, Enphase is handling the slowdown much better than its peer SolarEdge, which may translate to a competitive market advantage in the future depending on how its most significant competitor fares. Further, much of Enphase’s future will depend on whether or not Tesla looks to expand its solar business, which will likely mean operating at a loss. Of course, China’s production levels will continue to drive the market, potentially exacerbating the ongoing glut.

Fundamentally, I do not believe investors should expect a significant increase in residential solar demand. With interest rates much higher, solar does not have the same ROI it used to. The price of electricity is also no longer rising in most of the US, and overall consumer sentiment is lackluster, making for a poor durable goods economy.

For many years, solar has been seen as a growth opportunity. While that remains likely, I feel the solar market may be slow for a prolonged period. Of course, solar panel production is very China-centric and is subject to tariffs and geopolitical issues. Because Enphase sells inverters (needed to make solar panels work efficiently), I’d argue that a crackdown on China’s solar panels would be bearish (as it’s a complementary good). Thus, investors should not underestimate the many uncontrollable risks facing Enphase’s business.

I am neutral on ENPH today. Speculative traders may find value in a long ENPH short SEDG pair trade opportunity, but that still has high risks, given both ENPH and SEDG are down so much that they may rise dramatically as discount buyers look to them. I’d argue both are not discounted based on their fundamentals, but ENPH’s technical trend may be bullish as it is currently bouncing higher off its long-term support level. Personally, I’ll be watching ENPH and could turn bullish if it declines by another 20-30%, depending on changes to the precarious macroeconomic outlook.

Read the full article here