Investment Thesis

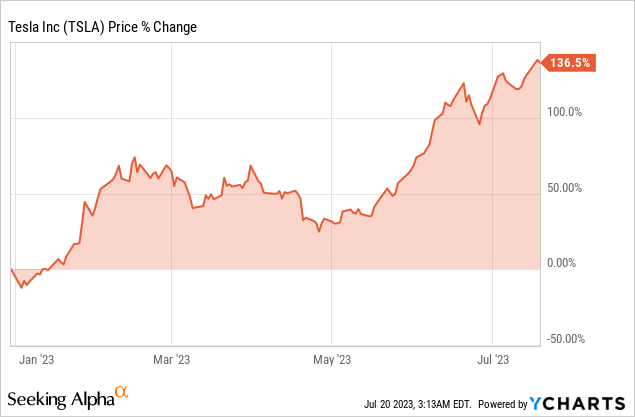

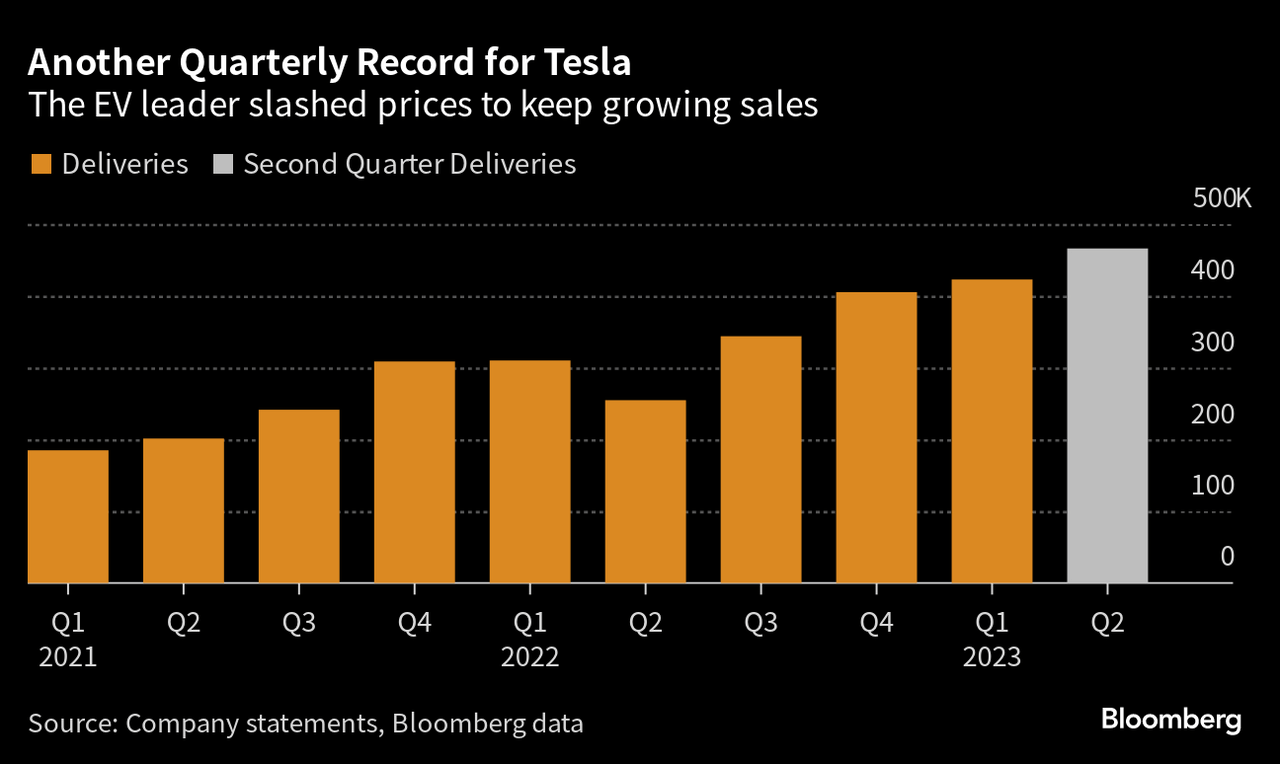

Tesla, Inc. (NASDAQ:TSLA) managed to beat earnings estimates for Q2 2023 after establishing a new milestone in vehicle deliveries for the quarter, delivering an impressive 466,140 vehicles globally, exceeding the street’s expectations of 448,000 and reflecting massive YoY growth. However, during the conference call, Tesla’s shares dropped 4% following the news that manufacturing outages will result in decreased output this quarter, while Elon Musk signaled that there would be additional price cuts this year.

Nevertheless, the onset of Full Self-Driving (FSD) should significantly raise the value of the Tesla fleet, making it a historic asset value change; therefore, strategically sacrificing margins to deliver more cars makes sense over the long term, reaffirming the buy rating.

Earnings Update

The surge in deliveries can be attributed to Musk’s decision to cut prices and introduce incentives, effectively driving demand. As a result, despite the elevated demand, the continued price drops led Tesla’s profit margins to fall. In the last three months, the company’s gross profit margin from automotive operations fell to 18.2%, compared to 18.8% in the first quarter of 2023 and 25.0% a year ago.

Wisely, Tesla sacrificed a small portion of its gross margins to boost and maintain its QoQ growth of 7% and YoY growth of 47%. Nevertheless, even at the current low levels, Tesla’s gross profit margins are higher than most conventional automakers, with most competitors lacking innovation and nowhere near Tesla’s competitive edge.

Tesla Remains A Game Changer In Autonomous Innovation

Musk noted that since the value of the cars would skyrocket after its FSD software, he was less concerned with profitability and more concerned with selling more cars in the short term. Admiringly, Tesla’s FSD has made remarkable strides in autonomous vehicle technology.

Tesla anticipates reaching an in-house neural net training capability of 100 exaflops by the following year, significantly enhancing their FSD capabilities. With over 300 million miles already driven using FSD beta, the data collected will soon grow to billions and tens of billions of miles, propelling FSD to surpass human driving capabilities by a substantial margin. Therefore, the potential to license their full self-driving software and hardware to other car companies opens new avenues for revenue generation while promoting widespread adoption of autonomous driving technology across the industry.

Additionally, Tesla recognizes that the main rate limiter in achieving FSD is training, and they are eager to increase training compute to expedite progress. While Tesla acknowledges past optimistic predictions regarding FSD, they remain confident in continuous improvement. Therefore, sacrificing margins to produce more vehicles is strategic, as the approval of FSD will drastically increase the value of the Tesla fleet, making it a historic asset value change.

Lastly, Tesla prioritizes heavy investment in core technologies such as AI, full self-driving, Optimus, and Dojo to drive sales. The growth in R&D spending, capacity expansion in vehicle factories, Supercharging networks, and battery processes establishes a solid foundation for future growth.

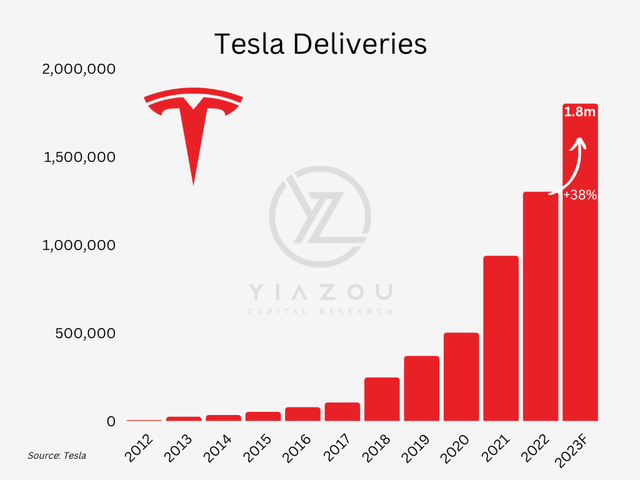

Finally, the U.S. electric car manufacturer restated its goal of delivering 1.8 million vehicles this year, indicating that profitability was still better than many Wall Street experts had expected.

Tesla Delivery Forecast

Record Delivery Numbers

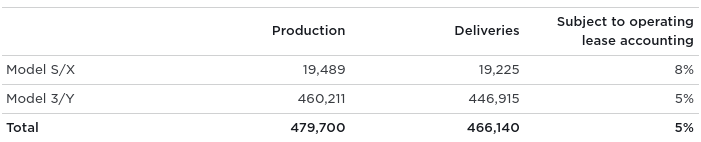

Tesla’s Q2 2023 vehicle production and deliveries demonstrated remarkable growth that surpassed market expectations. The EV giant produced nearly 480K vehicles and delivered over 466K vehicles during the quarter. The number of deliveries represents a significant strategic achievement for Tesla, indicating 83% YoY growth. Additionally, Tesla successfully reduced the gap between production and deliveries to 13,560 units in Q2 2023, narrowing the delta significantly to Q1 2023 (17,933 units).

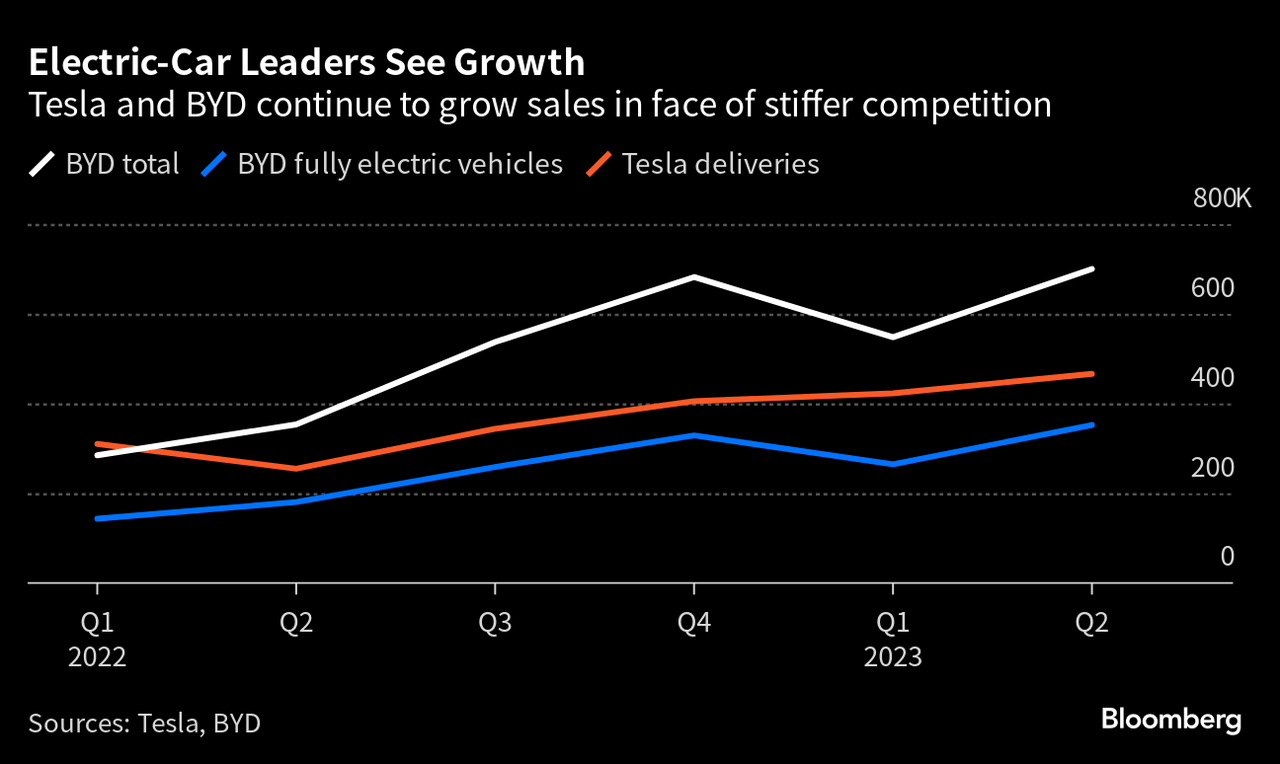

Bloomberg

Tesla’s strong delivery performance can be attributed to Elon Musk’s strategy of cutting prices to chase volume. The strategy intends to boost demand and alleviate concerns related to progressive price cuts. Price reductions and incentives such as free fast-charging and cash subsidies have made Tesla vehicles more affordable and attractive to a broader consumer base. The company has also been able to lower prices and qualify its Model 3 and Y for federal tax credits, which played a vital role in creating demand.

Although Tesla didn’t report specific numbers related to delivery, region, and vehicle type, the Model 3 and Y accounted for 96% of quarterly sales figures. These two models have been instrumental in leading Tesla’s revenue growth, especially in China, where Tesla counters enhanced competition from local manufacturers like BYD Company (OTCPK:BYDDF).

Tesla Vehicle Production & Deliveries Q2 2023

On the contrary, despite the increasing competition, Tesla is still the largest EV maker in the U.S., with a market share of 62% in Q1 2023. However, its market share has declined from over 70% in early 2022 due to the engagement of established legacy automakers like General Motors (GM), Ford Motor Company (F), and Volkswagen (OTCPK:VWAGY) in the EV market.

Finally, Tesla’s boosted deliveries are based on its expanded production capacity, including new Austin, Texas, and near Berlin factories. But impressive delivery numbers came at a cost. Tesla’s profitability has been impacted and is expected to be impacted by the need to cut prices to stimulate demand. The upcoming launch of the Cybertruck and partnerships with other automakers for charging network utilization may further boost the revenue streams and offset the lost profitability.

Long-Term Outlook Remains Positive

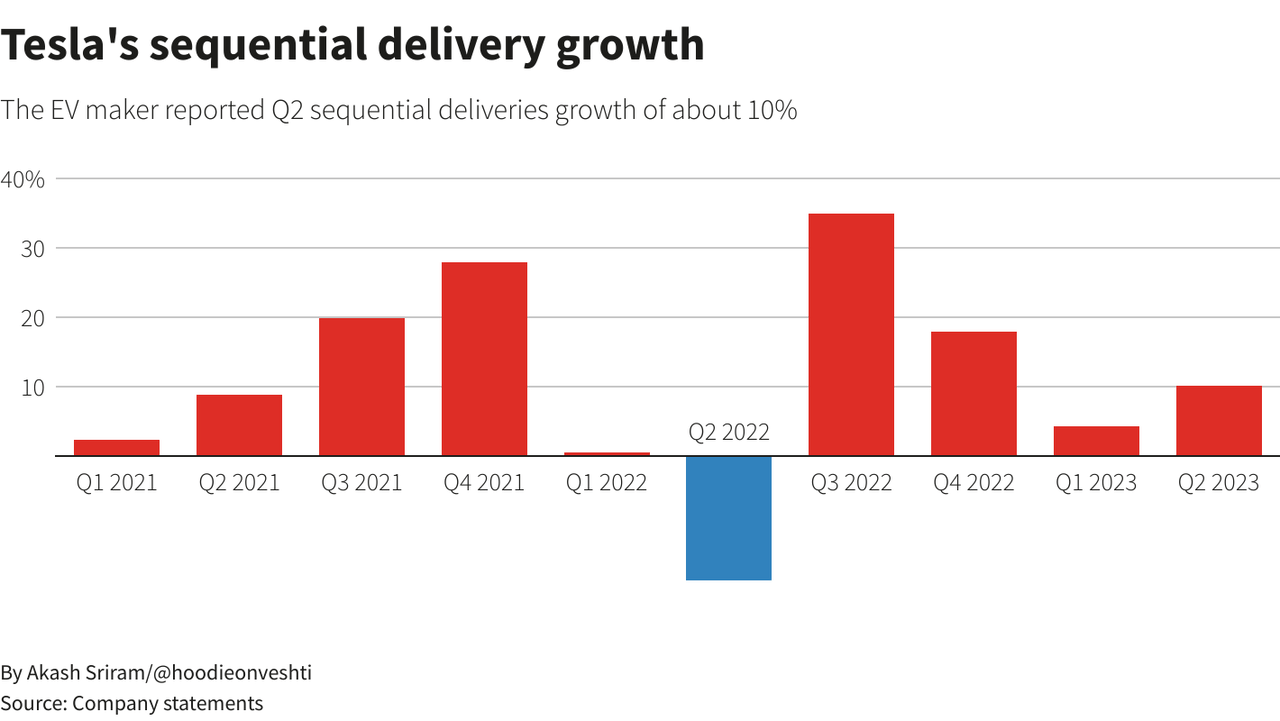

Tesla can experience significant benefits over the long term. In Q2 2023, the resumed sequential delivery growth at approximately 10% indicates Tesla’s ability to turn around by generating market demand and then matching it, which bodes well for its long-term growth.

reuters.com

One of the key factors contributing to Tesla’s success is its focus on increasing production efficiency. The narrowing of the gap between production and deliveries is a metric closely monitored by investors. A further reduction in the gap may provide a vital edge to Tesla over the long term. Thus, it is a sign of improving operational efficiency and the capability of fulfilling customer orders promptly.

Moreover, the successful implementation of Tesla’s price-cutting strategy signifies management’s effectiveness in driving sales and market share even during macroeconomic adversities prevailing in the industry. The notable aspect of Tesla’s strong deliveries is that the company remains a dominant EV maker even against solid competition in the United States and international markets.

In the U.S., Tesla’s strategy demonstrates that the growing competition from legacy automakers, which have expanded their EV offerings, may not be able to shake Tesla’s position. Similarly, in China, its second-largest market (following BYD), Tesla’s strong brand reputation, technological innovation, and growing charging infrastructure continue to support its position as an EV leader.

Undoubtedly, China is a vital marketplace for EV makers, and the automotive conglomerate has tried to stay competitive by reducing its premium models’ prices and providing buyers incentives. Nevertheless, Chinese automakers still pose a severe challenge to Tesla’s lead with their rapid lineups and grip on local tastes, with BYD leading the Chinese market.

Bloomberg

Another significant bullish catalyst for Tesla is its ability to benefit from government incentives and tax credits. For instance, introducing new rules in the U.S. allows Tesla buyers to qualify for a $7,500 federal tax credit. This trend can be global in the coming years, and coupled with fuel savings and lower maintenance costs, it can be a primary growth driver for Tesla as these cost savings will continue to make its EVs more cost-effective compared to traditional gasoline models. As governments worldwide continue to prioritize sustainability and encourage the adoption of EVs, Tesla is well-positioned to capitalize on these trends.

Further, Tesla’s continued expansion of its production capacity is also a long-term factor for growth. Tesla has increased its global manufacturing footprint with operational auto-assembly plants in Fremont, California; Austin, Texas; Shanghai; and Brandenburg, Germany. It has plans to build its first plant in Mexico and is exploring the possibility of expanding into India. These strategic moves will push Tesla further to capture a broader international market.

Tesla’s strong delivery numbers and production capabilities signify adequate progress toward attaining its annual delivery target of 1.8 million units. Once the target is virtually certain, the market’s sentiment towards Tesla may shift into another bullish trajectory for the long term in the ever-growing EV market.

However, the company has already produced over 920,000 vehicles in the first half, putting it on track to surpass that projection. Finally, the company plans to operate up to 12 Gigafactories worldwide by 2030, significantly enhancing production in the future, allowing Tesla to produce 20 million cars annually and supporting the bullish thesis.

Takeaway

In conclusion, Tesla’s remarkable delivery numbers in Q2 2023 exceeded market expectations and solidified the company’s position as the leader in the EV market. The successful implementation of price cuts and incentives has driven strong demand and enabled Tesla to achieve record-breaking delivery figures.

As Tesla continues to expand its production capacity and introduce new models, it faces challenges from increasing competition, particularly in China. However, with its innovative approach, focus on operational efficiency, and the upcoming launch of new vehicles like the Cybertruck, Tesla may become stronger to maintain its growth trajectory.

Lastly, the key takeaway from the latest earnings call is that Tesla’s FSD technology represents a monumental shift in the automotive landscape. With the potential for significant fleet value increase, diversification of revenue streams, and disruptive opportunities in transportation services, FSD stands as a true game changer for Tesla, propelling the company toward a more autonomous and sustainable future.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here