This article is part of a series that provides an ongoing analysis of the changes made to George Soros’s 13F stock portfolio on a quarterly basis. It is based on George Soros’s regulatory 13F Form filed on 08/15/2024. Please visit our Tracking Soros Fund Management Holdings article for an idea on his investment philosophy and our previous update for the fund’s moves during Q1 2024.

Soros Fund Management invests globally, and the long positions in the US market reported in the 13F filings represent ~25% of the overall portfolio. The 13F portfolio value decreased from $6.02B to $5.57B this quarter. The number of positions decreased from 193 to 177. Very small stock positions and large debt holdings together account for around two-thirds of the 13F holdings. The investments are diversified with a large number of very small equity positions, a small number of large equity positions, and a few large debt holdings. The focus of this article is on the larger equity positions. The top three individual stocks held as of Q2 2024 were AstraZeneca, Westrock, and Alphabet. To learn about Soros’ distinct trading style and philosophy, check out his “The Alchemy of Finance” and other works.

New stakes:

SPDR S&P 500 Index (SPY): SPY is a 4.40% of the portfolio position purchased this quarter at prices between ~$494 and ~$547 and the stock currently trades at ~$540.

Note: They also have a smaller position through Puts that partially offsets this long stake.

Apple (AAPL) Puts: The 2.84% of the portfolio AAPL short position through Puts was established this quarter as AAPL traded between ~$165 and ~$216. The stock is now at ~$221.

Note: The AAPL short position is back in the portfolio after a quarter’s gap. It was a short position through Puts established during Q3 2023. AAPL traded at prices between ~$170 and ~$196. The next quarter saw a ~20% selling as AAPL traded between ~$167 and ~$198. The stake was disposed during the last quarter as AAPL traded at prices between ~$169 and ~$195.

Costco Wholesale (COST) Puts: The 1.53% of the portfolio COST short position through Puts was established this quarter, as COST traded between ~$703 and ~$870. The stock currently trades at ~$877.

ChampionX (CHX): CHX is a 1.47% of the portfolio stake purchased this quarter at prices between $30.10 and $39.23 and the stock is now below that range at $28.86.

Rivian Automotive (RIVN) Calls: The 1.31% RIVN long position through Calls was established as RIVN traded between $8.40 and $14.74. It now goes for $13.23.

Stericycle (SRCL): The small 1.15% SRCL stake was established this quarter at prices between $44.30 and $59.20 and the stock currently trades above that range at $61.60.

Okta, Inc. (OKTA) Calls: The ~1% OKTA long position through Calls was purchased this quarter as OKTA traded between ~$87 and ~$104. The stock is now well below that range at $72.45.

PDD Holdings (PDD) Puts: The small 0.72% PDD short position through Puts was established this quarter as PDD traded at prices between ~$113 and ~$158. PDD is now at $93.30.

Note: The stake is back in the portfolio after a quarter’s gap. PDD was a short position through Puts established during Q3 2023. PDD traded at prices between ~$68 and ~$103. The next quarter saw a ~50% selling as PDD traded between ~$98 and ~$150. The stake was disposed during the last quarter as PDD traded at prices between ~$110 and ~$151.

Insmed (INSM), and JD.com (JD): These very small (less than ~0.60% of the portfolio each) stakes were established this quarter.

Stake Disposals:

American Equity Inv. Life (AEL): The 1.79% AEL merger-arbitrage stake was established during Q3 2023 at prices between ~$52 and ~$54. There was a ~23% stake increase in the last quarter at prices between ~$53 and ~$56. The position was increased by 17% this quarter at prices between $54.78 and $55.85. Brookfield acquired AEL in a $55 per share cash-and-stock deal ($38.85 cash and 0.49707 BAM stock) that closed in May.

Aramark (ARMK): The small 1.11% ARMK position was established during the last quarter at prices between $27.51 and $32.55. The disposal this quarter was at prices between $30.66 and $34.06. It is now at $36.67.

Cloudflare, Inc. (NET) Puts: The 2.41% short position through NET Puts was established in the last quarter as the underlying traded at prices between ~$76 and ~$108. The disposal this quarter happened as the underlying traded between $67.43 and $97. The stock currently trades at $76.05.

Synchrony Financial (SYF) Puts: The small 0.90% short stake through SYF Puts established last quarter was disposed this quarter.

Stake Increases:

AstraZeneca (AZN): AZN is currently the largest individual stock position at 3.44% of the portfolio. It was primarily built this quarter at prices between $66.40 and $80.34 and the stock currently trades above that range at $83.05.

Westrock: Westrock was a ~3% merger-arbitrage stake established last quarter. This quarter saw a 271% stake increase. The transaction closed in July. Shareholders received ~$43.50 per share in cash-and-stock.

SPDR S&P 500 Index Puts: The short position through SPY Puts was increased by ~70% this quarter, as SPY traded between ~$494 and ~$547. The stock is now at ~$540.

Note: They also have a larger long position that offsets this short stake.

Axonics, Inc. (AXNX): AXNX is a 2.14% of the portfolio position primarily built this quarter at prices between $66.47 and $69.65. The stock currently trades at $68.83.

Cerevel Therapeutics (CERE): CERE was a 1.58% of the portfolio merger-arbitrage stake established during the last quarter at prices between $40.88 and $43.27. This quarter saw a ~11% stake increase at prices between $38.96 and $42.75. AbbVie acquired CERE in a $45 per share all-cash transaction that closed last month.

Alibaba Group Holding (BABA) & Calls, Accenture plc (ACN), EchoStar (SATS), Jacobs Solutions (J), Marriot Vacations Worldwide (VAC) Calls, Merck & Co. (MRK), and Uber Technologies (UBER): These small (less than ~1.5% of the portfolio each) stakes were increased during the quarter.

Stake Decreases:

Alphabet Inc. (GOOG): GOOG is a ~3% of the portfolio position purchased in Q2 2019 at prices between ~$52 and ~$64 and reduced by ~50% in Q1 2020 at prices between ~$53 and ~$76. Q4 2020 saw another similar selling at prices between ~$71 and ~$86. There was a ~250% stake increase in the next quarter at prices between ~$86 and ~$107. H2 2021 had seen a ~50% reduction at prices between ~$133 and ~$151. Next quarter saw a one-third increase at prices between ~$127 and ~$148. That was followed with an ~80% stake increase during Q4 2022 at prices between ~$83.50 and ~$105. The next four quarters saw selling while the last quarter saw the position increased by 22% at prices between ~$133 and ~$155. There was a ~40% selling this quarter at prices between ~$152 and ~$187. The stock is now at ~$152.

Note: Alphabet is a frequently traded stock in Soros’ portfolio.

AerCap Holdings (AER): The 2.61% AER stake was increased by ~120% during Q3 2023 at prices between ~$60 and ~$67. There was a one-third increase in the next quarter at prices between ~$57.50 and ~$75. The stake was decreased by 20% during the last quarter at prices between ~$71 and ~$88. That was followed by a ~21% reduction this quarter at prices between $82.05 and $96.65. The stock currently trades at $90.60. They are harvesting gains.

Booking Holdings (BKNG): BKNG is a small 1.16% stake that was increased by ~25% over the last two quarters at prices between ~$2743 and ~$3902. The stock currently trades at ~$3731. There was a ~9% trimming this quarter.

CRH plc (CRH): CRH is a small 0.81% stake that was reduced by roughly one-third during Q4 2023 at prices between ~$52 and ~$69. The stake was further decreased by 46% during the last quarter at prices between ~$66 and ~$87. This quarter also saw a ~24% reduction at prices between $72.72 and $86.02. The stock is now at $85.33.

Novo Nordisk (NVO): The 0.45% NVO position was established during Q3 2023 at prices between ~$75.40 and ~$100. The stake was decreased by 49% during the last quarter at prices between ~$101 and ~$135. The position was sold down by ~80% this quarter at prices between ~$123 and ~$147. The stock currently trades at ~$131.

Invesco QQQ Trust (QQQ) Puts: The large 6.31% of the portfolio short stake through Puts as of last quarter was almost sold out this quarter. The position was established during Q4 2022 as QQQ traded between ~$260 and ~$294. The next quarter saw a one-third reduction as the underlying traded between ~$262 and ~$321. Q2 2023 saw a ~160% stake increase as QQQ traded at prices between ~$310 and ~$370. That was followed by another two-thirds increase in the next quarter, as QQQ traded at prices between ~$354 and ~$385. Q4 2023 saw the position reduced by ~60% as the underlying traded between ~$344 and ~$412. The position was increased by 42% in the last quarter, as QQQ traded at prices between ~$396 and ~$446. The stake was almost sold out this quarter, as QQQ traded between ~$414 and ~$484. QQQ currently trades at ~$449.

Amazon.com (AMZN), Confluent, Inc. (CFLT) Calls, and Cboe Global Markets (CBOE): These small (less than ~1% of the portfolio each) stakes were reduced this quarter.

Kept Steady:

Liberty Broadband (LBRDK): LBRDK stake is now relatively small at 1.37% of the portfolio. The original large position was established in Q2 2016 at prices between $55 and $60.50. Q4 2019 saw a ~20% selling at prices between $103 and $125. Q1 2021 saw a similar reduction at prices between ~$142 and ~$157. The four quarters through Q3 2022 saw another roughly two-thirds reduction at prices between ~$74 and ~$191. The stock currently trades at $60.64.

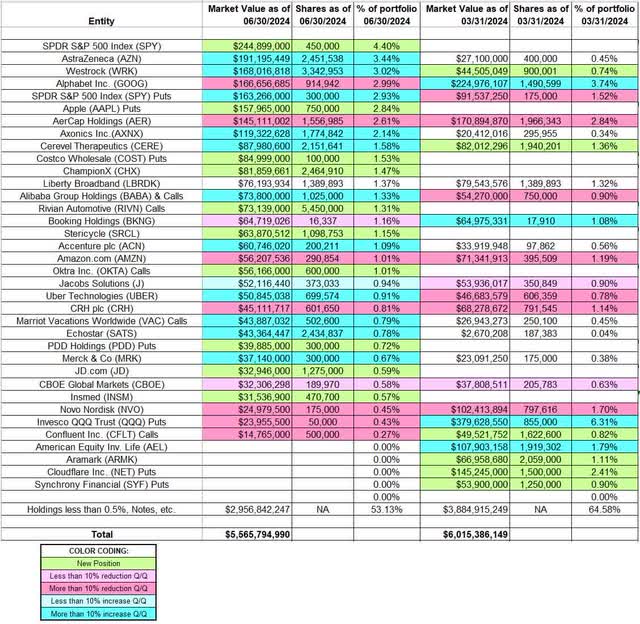

The spreadsheet below highlights Soros’s significantly large 13F positions as of Q2 2024:

George Soros – Soros Fund Management Portfolio – Q2 2024 13F Report Q/Q Comparison (John Vincent (author))

Source: John Vincent. Data constructed from Soros Fund Management’s 13F filings for Q1 2024 and Q2 2024.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here